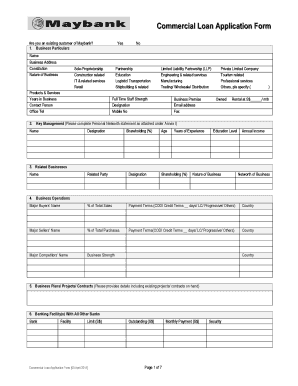

Commercial Loan Application Form Templates

What are Commercial Loan Application Form Templates?

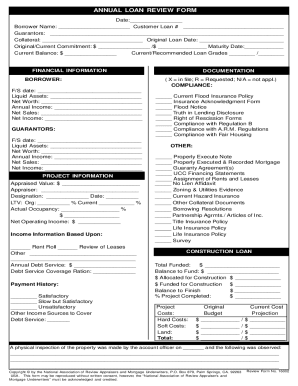

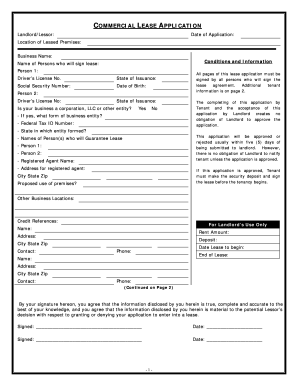

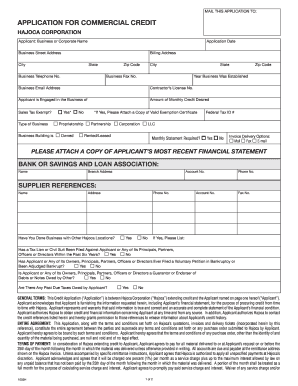

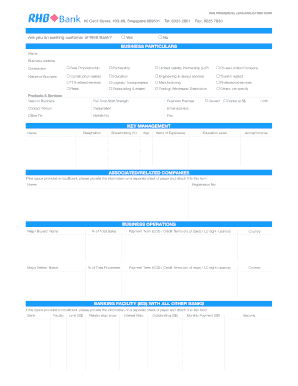

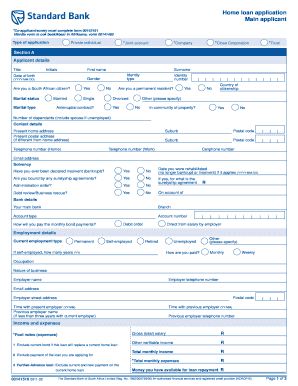

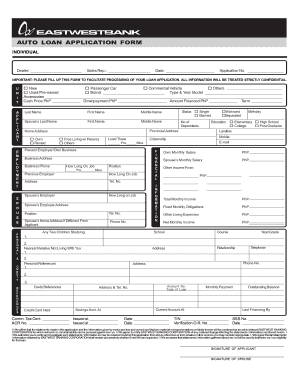

Commercial Loan Application Form Templates are standardized forms that businesses use to apply for loans from financial institutions. These forms typically require detailed information about the business's financial history, assets, liabilities, and the purpose of the loan.

What are the types of Commercial Loan Application Form Templates?

There are several types of Commercial Loan Application Form Templates, including: 1. Small Business Loan Application Form 2. Real Estate Loan Application Form 3. Equipment Financing Application Form 4. Business Line of Credit Application Form 5. SBA Loan Application Form

How to complete Commercial Loan Application Form Templates

Completing Commercial Loan Application Form Templates is a straightforward process that involves providing accurate and detailed information about your business. To complete the form successfully, follow these steps: