Truth-in Lending Disclosure Statement Pdf

What is Truth-in lending disclosure statement pdf?

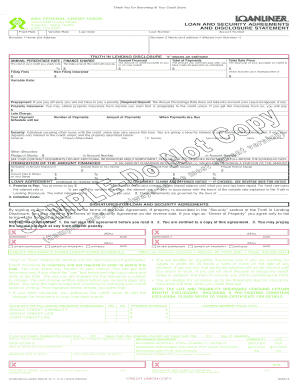

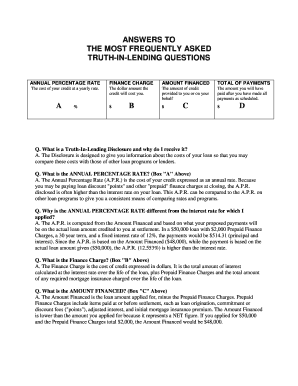

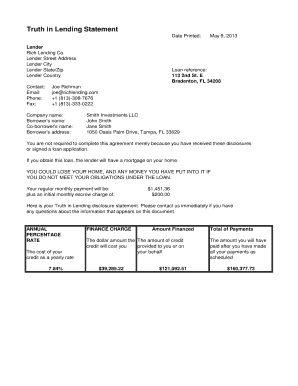

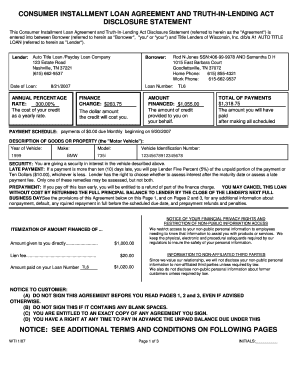

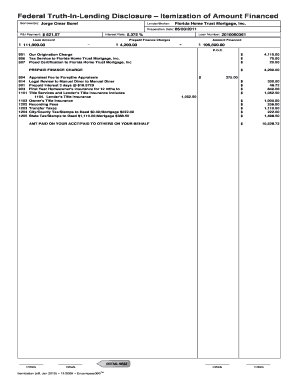

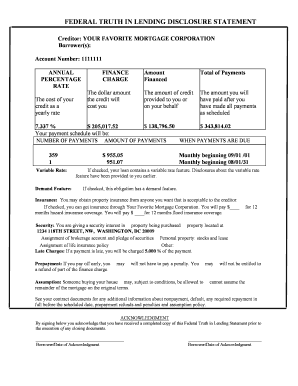

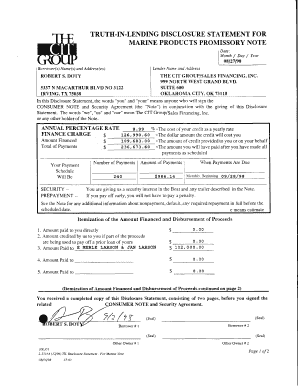

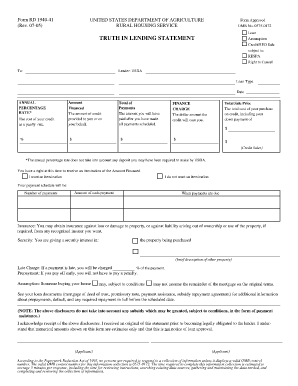

The Truth-in-Lending Disclosure Statement PDF is a document provided by lenders to borrowers that outlines the important terms and costs of a loan agreement. It includes details on the loan amount, interest rate, APR, payment schedule, and any fees associated with the loan.

What are the types of Truth-in lending disclosure statement pdf?

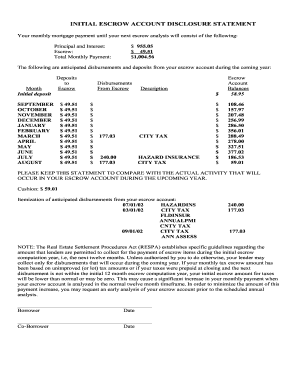

There are two main types of Truth-in-Lending Disclosure Statement PDFs: initial disclosure statements and closing disclosure statements.

Initial Disclosure Statement

Closing Disclosure Statement

How to complete Truth-in lending disclosure statement pdf

To complete a Truth-in-Lending Disclosure Statement PDF, follow these steps:

01

Review the document carefully to ensure all information is accurate.

02

Fill in all required fields with the necessary details.

03

Verify all calculations and double-check the numbers for accuracy.

04

Sign the document electronically or print it out and sign manually if required.

05

Share the completed PDF with the lender or other relevant parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Truth-in lending disclosure statement pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the truth in lending disclosure statements?

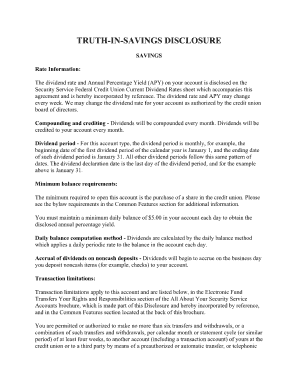

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms. TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested.

What disclosures are required by TILA?

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms.

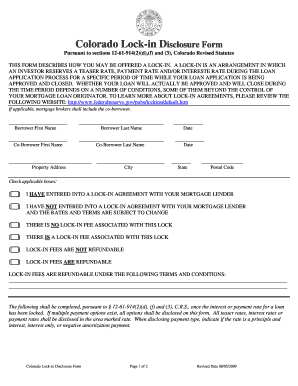

How many disclosure forms are required by the new TILA-RESPA guideline?

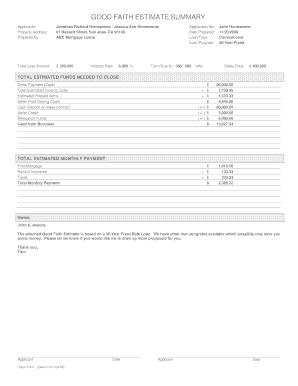

The TILA-RESPA rule consolidates four existing disclosures required under TILA and RESPA for closed-end credit transactions secured by real property into two forms: a Loan Estimate that must be delivered or placed in the mail no later than the third business day after receiving the consumer's application, and a Closing

What are the 6 things they must disclose under the Truth in Lending Act?

Lenders have to provide borrowers a Truth in Lending disclosure statement. It has handy information like the loan amount, the annual percentage rate (APR), finance charges, late fees, prepayment penalties, payment schedule and the total amount you'll pay.

What disclosures are required by Regulation Z?

Created to protect people from predatory lending practices, Regulation Z, also known as the Truth in Lending Act, requires that lenders disclose borrowing costs, interest rates and fees upfront and in clear language so consumers can understand all the terms and make informed decisions.

What is the general requirements that apply to all Truth in Lending disclosures?

The Truth in Lending Act (TILA) helps protect consumers from unfair credit practices by requiring creditors and lenders to pre-disclose to borrowers certain terms, limitations, and provisions—such as the APR, duration of the loan, and the total costs—of a credit agreement or loan.