Truth In Lending Disclosure Form Pdf

What is Truth in lending disclosure form pdf?

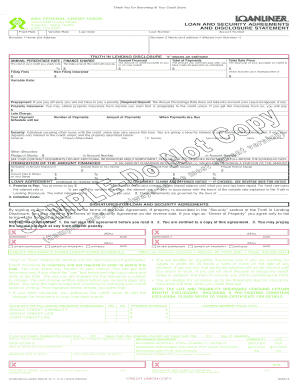

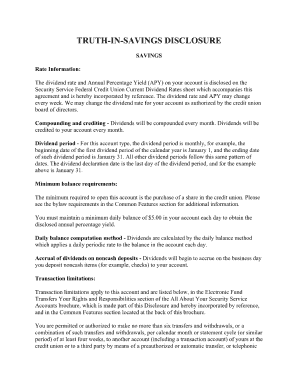

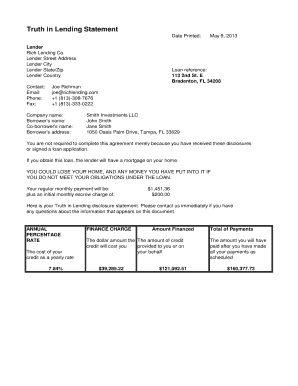

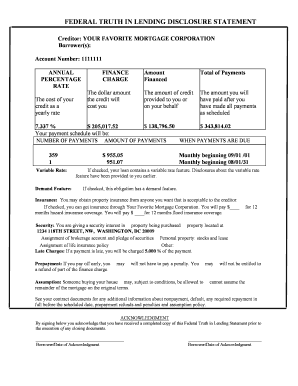

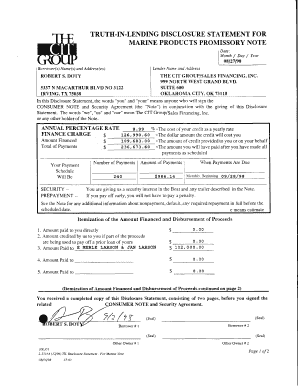

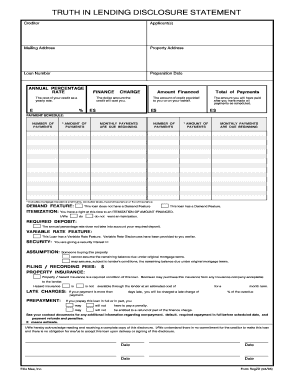

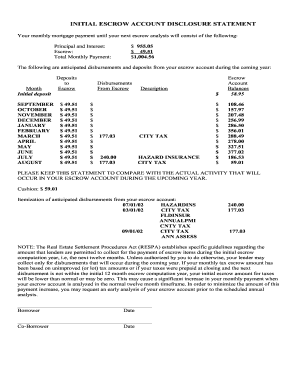

The Truth in Lending disclosure form PDF is a document that lenders are required to provide to borrowers under federal law. It outlines important information about the terms of a loan, including the annual percentage rate (APR), finance charges, and total payment amount.

What are the types of Truth in lending disclosure form pdf?

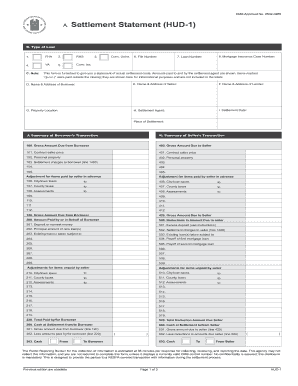

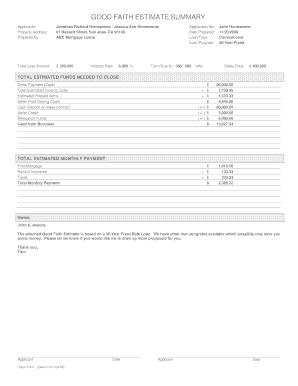

There are two main types of Truth in Lending disclosure forms in PDF format: the initial disclosure form, which is provided to the borrower within three business days of applying for a loan, and the closing disclosure form, which is given to the borrower at least three days before closing on a loan.

How to complete Truth in lending disclosure form pdf

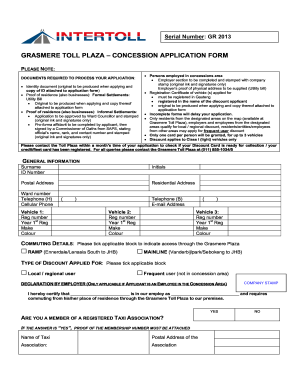

Completing the Truth in Lending disclosure form in PDF format is a straightforward process. Here are the steps to follow to fill out the form accurately:

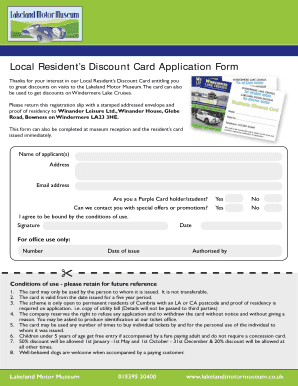

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.