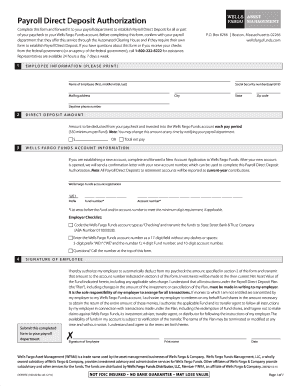

Wells Fargo Bank Verification Form

What is Wells Fargo bank verification form?

The Wells Fargo bank verification form is a document that allows individuals or organizations to verify a person's bank account information and can be used for various purposes such as loan applications, employment verification, or proof of income.

What are the types of Wells Fargo bank verification form?

There are several types of Wells Fargo bank verification forms depending on the purpose of verification. Some common types include:

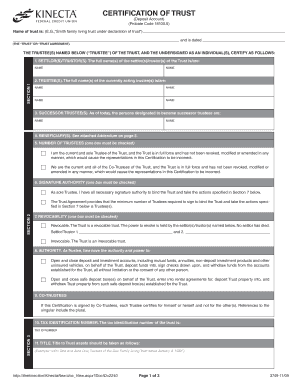

Direct deposit verification form

Income verification form

Account verification form

How to complete Wells Fargo bank verification form

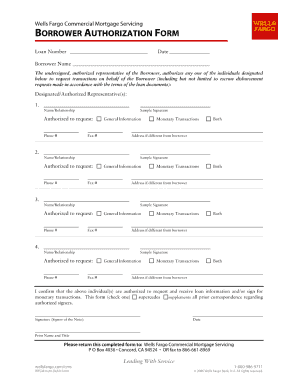

Completing the Wells Fargo bank verification form is a simple process that involves the following steps:

01

Fill out your personal information including name, address, and contact details

02

Provide your bank account information accurately

03

Sign and date the form to authorize the verification process

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Wells fargo bank verification form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why is bank account verification required?

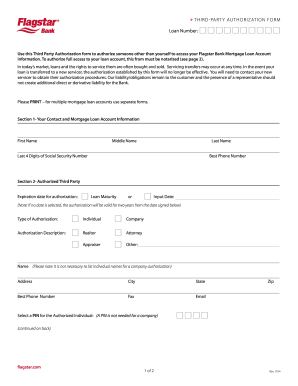

Introduction. Bank Account verification is a mandatory part of customer onboarding due diligence to ensure the legitimacy of the ultimate beneficial owner. It ensures whether the funds coming in or going out have no illegal connection that may charge the other party with severe legal consequences and repercussions.

How do I get a bank account verification form?

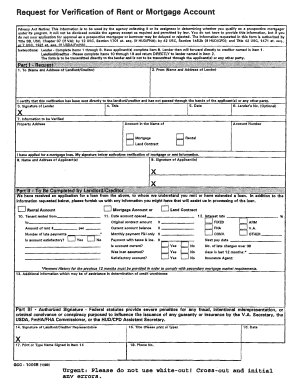

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

What is a bank account verification form?

A bank verification form is a document that institutions or individuals use to confirm and verify the details of a person's or a company's bank account. By authenticating the bank account information the account holder has provided, you reduce the risk of fraud and other financial malpractice.

How to get a bank account verification letter from Wells Fargo?

How to download a bank verification letter Navigate to the Accounts tab. Select the checking account for which you want a bank verification letter. Select the Three Vertical Dots beside the Add Money button. Select Request Bank Verification Letter from the dropdown menu.

What can I use as bank account verification?

A bank encoded deposit slip with pre-printed details of your bank account. name and number. A copy of a cheque for your bank account. A copy of a bank account statement. A verification letter or other document of confirmation provided by your bank. A printed version of your bank account details from your online banking.

How long does it take Wells Fargo verify bank account?

To enable non-Wells Fargo accounts for Transfers, additional security measures are required. Verification may take 1-3 business days.