Sba Loan

What is SBA loan?

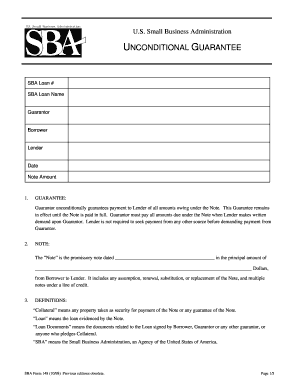

An SBA loan is a loan provided by the Small Business Administration to help small businesses with financing. These loans are meant to support entrepreneurs and business owners in starting, expanding, or recovering their businesses.

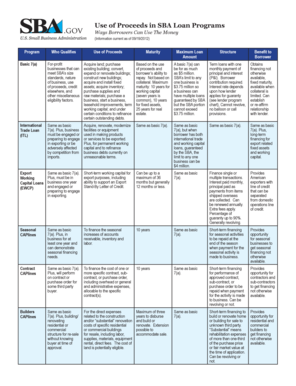

What are the types of SBA loan?

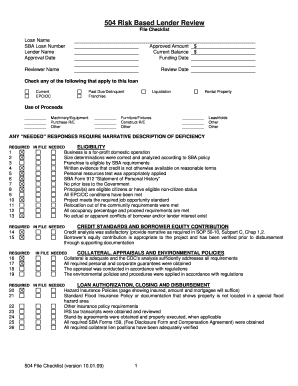

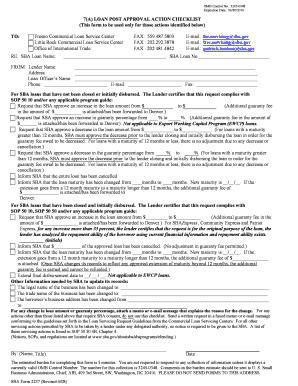

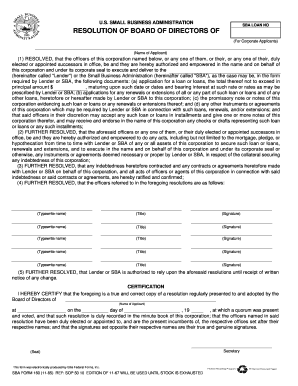

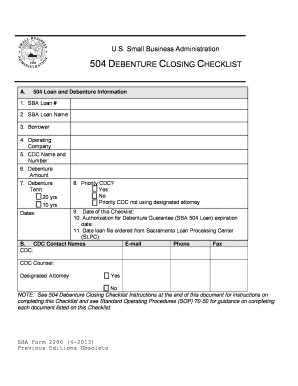

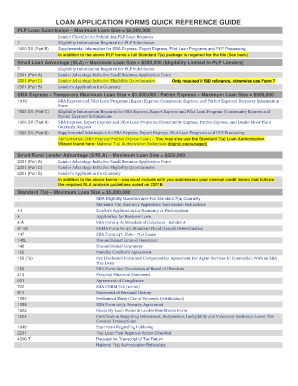

There are several types of SBA loans available to business owners, including: - SBA 7(a) Loan - SBA Express Loan - SBA 504 Loan - SBA Microloan - SBA Disaster Loan

How to complete SBA loan

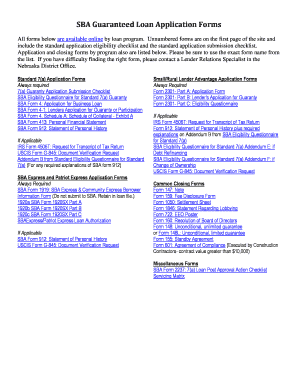

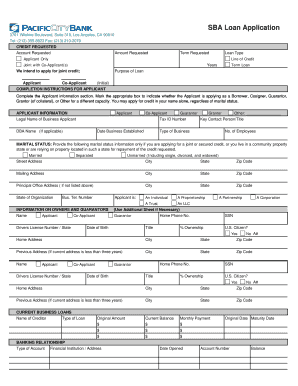

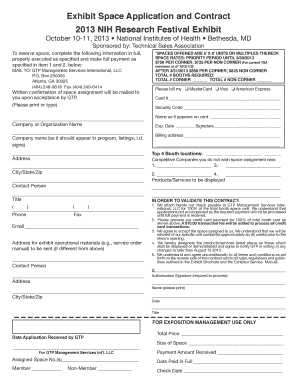

Completing an SBA loan application can be a daunting task, but with the right guidance, it can be a smooth process. Here are some steps to help you complete your SBA loan application:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.