Sba Personal Financial Statement Pdf

What is Sba personal financial statement pdf?

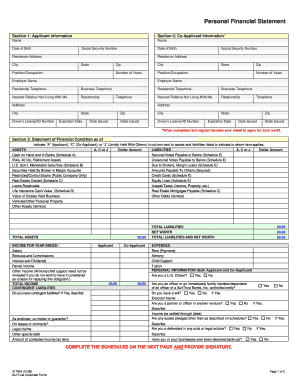

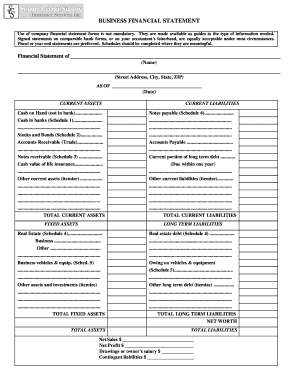

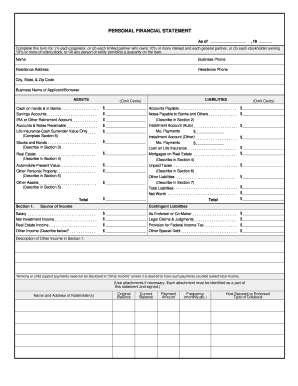

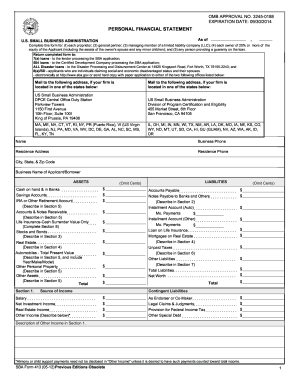

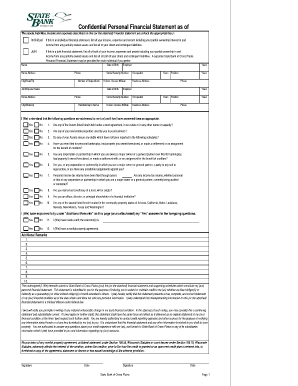

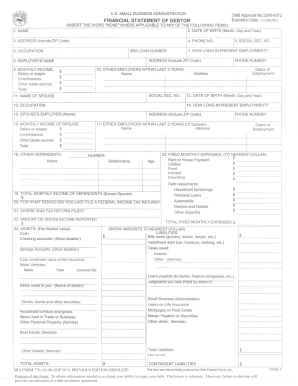

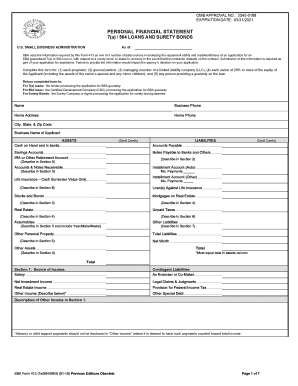

SBA personal financial statement PDF is a document that individuals use to provide information about their financial situation. It includes details such as assets, liabilities, income, and expenses to help assess their financial health and eligibility for loans and financial assistance.

What are the types of Sba personal financial statement pdf?

There are two main types of SBA personal financial statement PDF:

Personal Balance Sheet: This type includes details of an individual's assets, liabilities, and net worth.

Personal Income Statement: This type outlines an individual's income, expenses, and resulting net income.

How to complete Sba personal financial statement pdf

Completing an SBA personal financial statement PDF is a straightforward process. Here are the steps to follow:

01

Gather all necessary financial documents, such as bank statements, investment accounts, and loan statements.

02

Fill in the required information accurately, including details of your assets, liabilities, income, and expenses.

03

Review the completed form for accuracy and make any necessary corrections before submission.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sba personal financial statement pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the personal financial statement for a loan application?

What should be included in a personal financial statement? A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.

What is SBA personal financial statement?

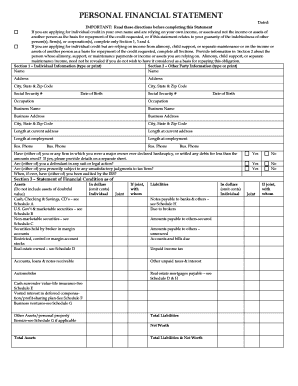

SBA uses this form to assess the financial situation of applicants for multiple SBA programs and certifications.

How do I fill out a personal financial statement for SBA?

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program. Step 2: Fill In Your Personal Information. Step 3: Write Down Your Assets. Step 4: Write Down Your Liabilities. Step 5: Fill Out the Notes Payable to Banks and Others Section. Step 6: Fill Out the Stocks and Bonds Section.

What is SBA Personal Financial statement Form 413?

SBA uses the information required by this Form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an applicant for an SBA loan or, with respect to a surety bond, to assist in recovery in the event that the contractor defaults on the contract.

Does SBA require financial statements?

In addition to required forms that the SBA supplies, you and your business affiliates need to provide financial statements for your business. This helps demonstrate your ability to repay the loan.

What is a personal financial statement for a business loan?

A personal financial statement is a spreadsheet that details the assets and liabilities of an individual, couple, or business at a specific point in time. Typically, the spreadsheet consists of two columns, with assets listed on the left and liabilities on the right.