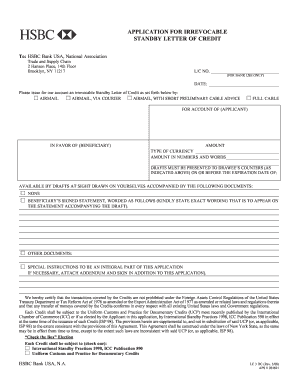

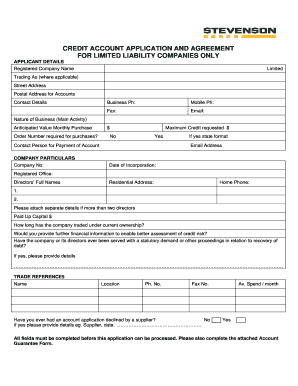

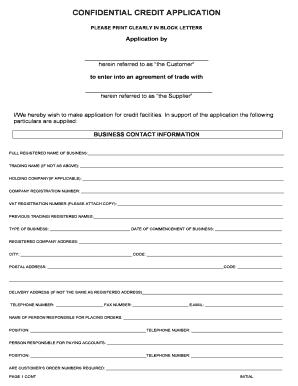

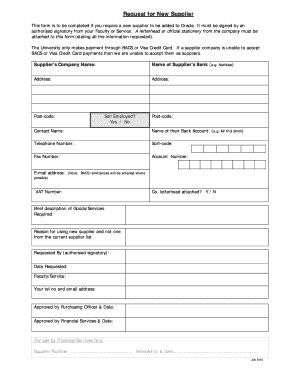

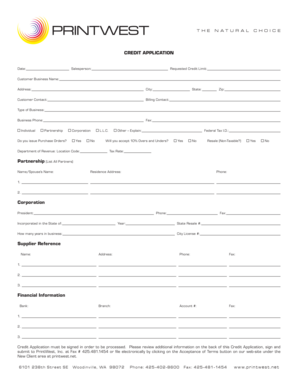

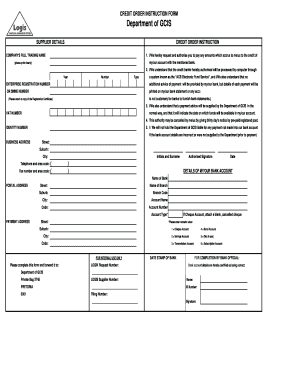

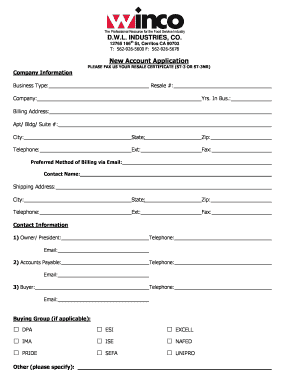

Supplier Credit Application Form

What is Supplier credit application form?

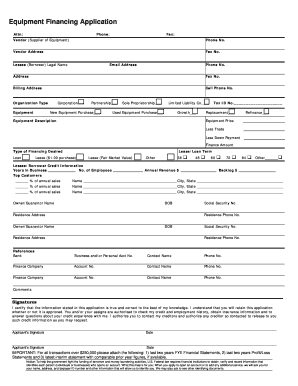

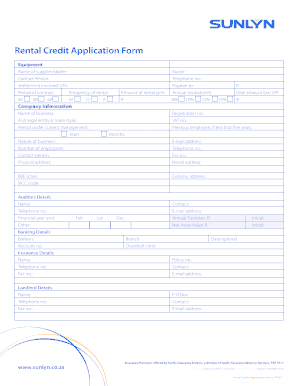

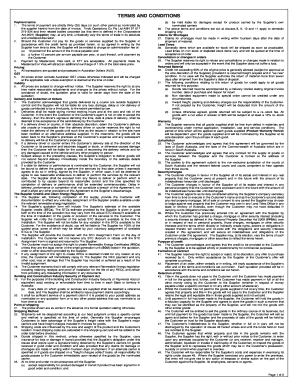

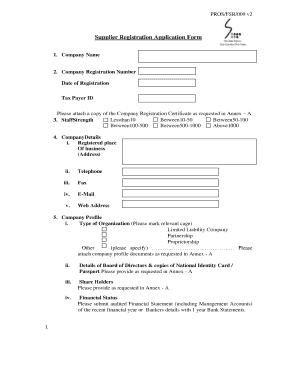

The Supplier credit application form is a document that businesses use to apply for credit terms with their suppliers. This form helps suppliers assess the creditworthiness of potential customers and determine their ability to pay for goods or services on credit.

What are the types of Supplier credit application form?

There are several types of Supplier credit application forms that businesses can use, including:

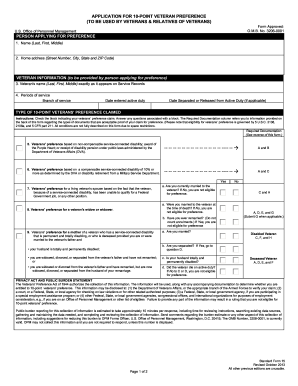

Standard Supplier credit application form

Personal Guarantee Supplier credit application form

Trade Reference Supplier credit application form

How to complete Supplier credit application form

To successfully complete a Supplier credit application form, follow these steps:

01

Fill in your business details accurately

02

Provide information about your financial history and credit references

03

Sign the form and submit it to your supplier for review

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Supplier credit application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why do vendors need credit application?

The key goal of a credit application is to assist the seller in learning as much as possible about the applicant before making a decision to extend credit. The credit application is often considered to be the cornerstone of the customer's file.

What is a credit application mean?

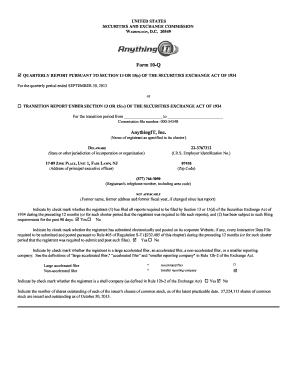

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.

What is a supplier application form?

The supplier application form can be used to allow businesses apply to become a supplier for your business. With this form, applicants can fill out their business type, business information, description of goods, and so on. The feedback gotten from applicants can be used to pick suitable suppliers for your business.

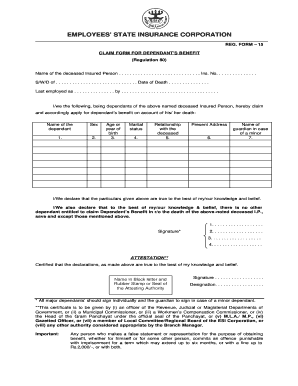

What should be included in a credit application?

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line.

How do you draft a credit application?

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line.

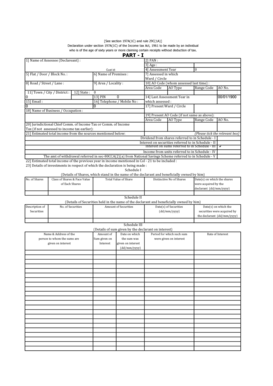

What is a credit application for a vendor?

The credit application (Application) is the. initial document used by Vendors to collect. information and establish contractual terms. with the Applicant.