Car Loan Application Form Templates

What are Car Loan Application Form Templates?

Car Loan Application Form Templates are pre-designed forms that individuals use to apply for a car loan. These templates streamline the application process by providing a structured format for applicants to input their personal and financial information.

What are the types of Car Loan Application Form Templates?

There are several types of Car Loan Application Form Templates available, including:

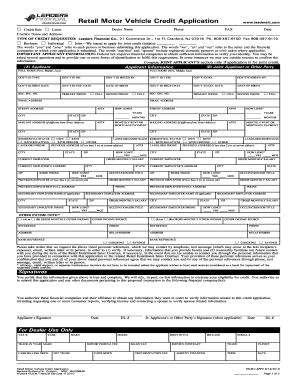

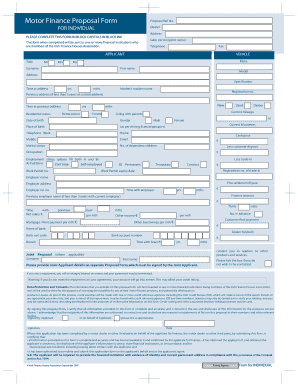

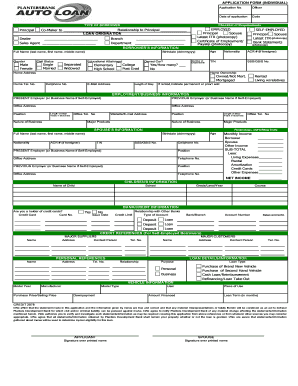

Basic Car Loan Application Form Template

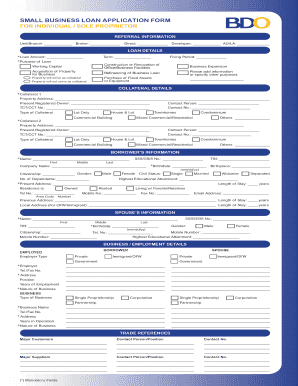

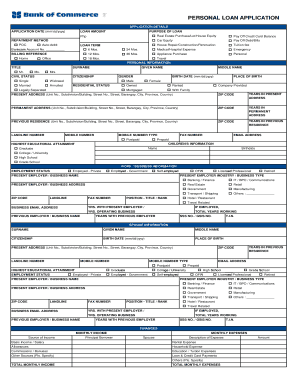

Detailed Car Loan Application Form Template

Online Car Loan Application Form Template

How to complete Car Loan Application Form Templates

Completing Car Loan Application Form Templates is easy and straightforward. Follow these simple steps:

01

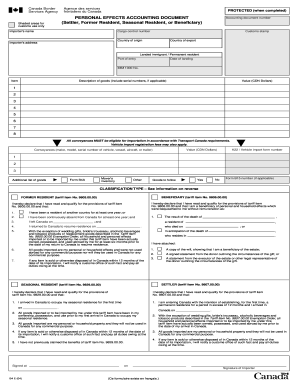

Fill in personal information such as name, address, contact details, and employment status.

02

Provide financial details including income, expenses, and credit history.

03

Submit any required documentation such as proof of income, identification, and vehicle details.

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. pdfFiller is the only PDF editor users need to get their documents done efficiently.

Video Tutorial How to Fill Out Car Loan Application Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What matters most when applying for a car loan?

The outcome of your loan application is heavily dependent on your credit history. It determines important factors such as interest rates, payment terms, and the total amount you can borrow. Having a low credit score might reduce your chances of getting approved, so you should look into your credit reports first.

How do they approve you for a car loan?

Lenders want to determine that you have the ability to repay your auto loan before they finance a car. This goes beyond just running numbers based on an interest rate. Lenders should assess your income, assets, employment, credit history and monthly expenses to determine that you're able to pay back the loan.

How to write a loan application form?

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

What is included in a loan application form?

Loan application forms are used to gather the following types of information: Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.)

What does it mean to apply for a car loan?

To get a car loan, you will need to apply and be approved by a lender. You can apply at banks, credit unions, online lenders and at the car dealership. Many lenders will pre-qualify you for a loan in a few minutes and estimate an interest rate based on your credit history and answers to some simple questions.

What do banks look for when applying for a car loan?

Lenders look at your credit worthiness as well as how much they'll need to lend you. Making a down payment signals that you're more likely to pay off your loan in a reliable way. Plus, the down payment reduces the amount of the overall loan.