Sample Car Loan Application Pdf

What is Sample car loan application pdf?

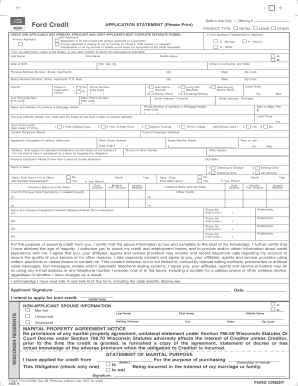

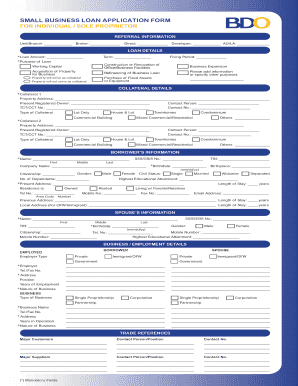

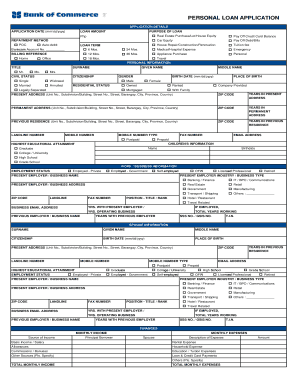

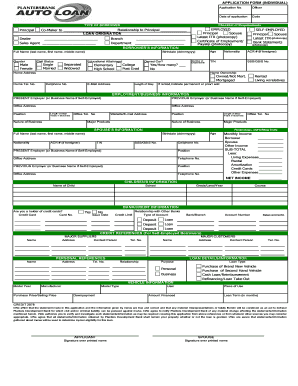

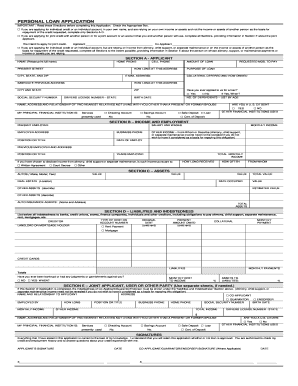

The Sample car loan application pdf is a standardized form used by individuals seeking financing to purchase a vehicle. This form collects essential information such as personal details, employment history, and financial information required by lenders to assess creditworthiness.

What are the types of Sample car loan application pdf?

There are primarily two types of Sample car loan application pdf:

Individual car loan application: This type is completed by a single individual seeking financing for a vehicle purchase.

Joint car loan application: This type is filled out by two or more individuals applying for a car loan together, often sharing responsibility for repayment.

How to complete Sample car loan application pdf

Completing a Sample car loan application pdf is a straightforward process that involves the following steps:

01

Gather necessary documents: Collect documents such as proof of income, identification, and vehicle information.

02

Fill out the form accurately: Provide all requested information truthfully and accurately to avoid delays in the loan approval process.

03

Review and submit: Review the completed form for any errors or missing information before submitting it to the lender.

04

Sign and send: Sign the form electronically or in ink, then send it to the lender along with any additional required documents.

05

Keep a copy: Make sure to keep a copy of the completed application for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I make sure I get approved for a car loan?

How to Increase Your Odds of Approval Check your credit: Check both your credit score and your credit reports. Save up a down payment: The more you can save first, the smaller the loan you'll need. Pay down credit card debt: Lenders use your debt-to-income ratio to help calculate how much you can borrow.

How do I write a letter to finance?

If you are interested in writing a finance cover letter that attracts the attention of employers, here are some steps you can take: Find a template. Include relevant contact information. Include a greeting. Provide background information. Explain why you want to work in finance. Say why you want to work for the company.

How do I write a letter to the bank asking for a loan?

My account number is ***********. My purpose for writing this letter is that I want a small personal loan of the amount _____. I also provide all the documents that you need to release a personal loan for me. Therefore, I hope you will approve my request as soon as possible.

How long does it take for a car loan to be approved by the bank?

Dealerships: will generally approve loans the same day, although it could take a few business days. Banks and credit unions: can take anywhere from one business day to a few weeks to approve a loan depending on whether you're a new customer and their loan backlogs.

What kind of interest rate can I get on a car loan?

Average Car Loan Interest Rates by State StateNew Car Loan Interest RatesUsed Car Loan Interest RatesCalifornia6.57%9.78%Colorado6.78%10.11%Connecticut6.27%10.31%Delaware7.02%11.02%47 more rows • Jun 5, 2023

How do I write a formal letter to request a loan?

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. Mention the purpose of the loan. Assure the lender of repayment. Closing the business loan request letter.