Personal Loan Application Form Download - Page 2

What is Personal loan application form download?

A Personal loan application form download is a document that allows individuals to apply for a personal loan by filling out necessary information online or offline.

What are the types of Personal loan application form download?

There are several types of Personal loan application form downloads, including:

Online fillable forms on lender websites

Printable PDF forms that can be downloaded and filled out by hand

Mobile app-based forms for convenient on-the-go applications

How to complete Personal loan application form download

To successfully complete a Personal loan application form download, follow these steps:

01

Download the form from a reputable lender's website

02

Fill out all required fields with accurate information

03

Double-check your entries for accuracy and completeness before submitting the form

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Personal loan application form download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is it safe to take a loan online?

Many online loans are legit. Banks and other institutions that offer online loans must meet the same rigorous criteria as traditional banks to lend money. That's not to say you shouldn't be wary of potential scams, but there are a few factors you can examine to assess if an online lender is legitimate.

Can I fill out a loan application online?

You can normally apply online or in person and will have to provide some basic personal and financial information. Your lender will consider your employment status, income, outstanding debts, and overall credit score to assess whether you are eligible for a loan and determine the interest rate that you will pay.

What is the easiest type of loan to get approved for?

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

How to write a loan application form?

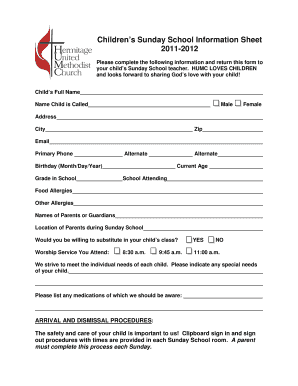

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

Can you apply for a loan without taking it?

Can You Apply for a Loan and Not Accept It? Yes. If a lender has approved your application for a personal loan, you're not required to take it. This is an important distinction from credit cards, where your account is opened immediately upon approval.

What is a personal loan application form?

Loan application forms are used to gather the following types of information: Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.)