Cfpb Privacy Notice Template

What is Cfpb privacy notice template?

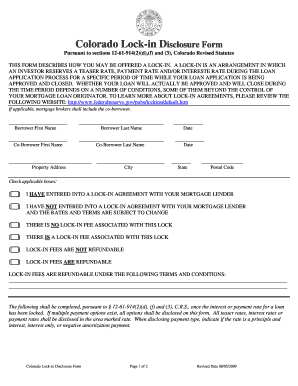

The CFPB privacy notice template is a standardized form provided by the Consumer Financial Protection Bureau (CFPB) for financial institutions to inform consumers about their privacy policies and practices regarding the collection and sharing of personal information.

What are the types of Cfpb privacy notice template?

There are two main types of CFPB privacy notice templates: annual privacy notices and opt-out notices. The annual privacy notice informs consumers about how their personal information is collected, used, and shared by the financial institution. The opt-out notice allows consumers to request that their information not be shared with certain third parties.

How to complete Cfpb privacy notice template

Completing the CFPB privacy notice template is simple and straightforward. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.