Regulation E Model Disclosure Clauses And Form Templates

What are Regulation E Model Disclosure Clauses and Form Templates?

Regulation E Model Disclosure Clauses and Form Templates are standardized forms provided by the Federal Reserve Board to assist financial institutions in disclosing information to consumers about electronic fund transfers. These forms help ensure that consumers are informed about their rights and responsibilities when it comes to electronic transactions.

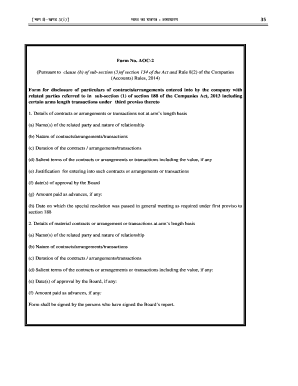

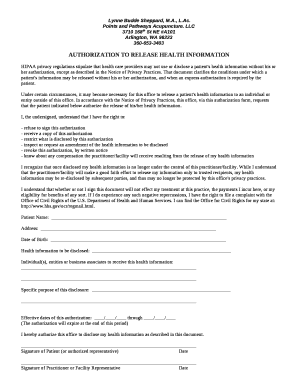

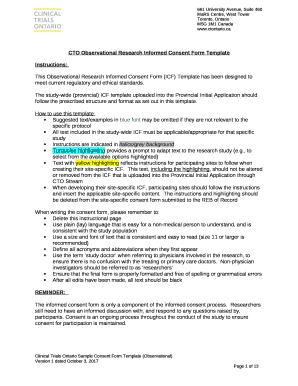

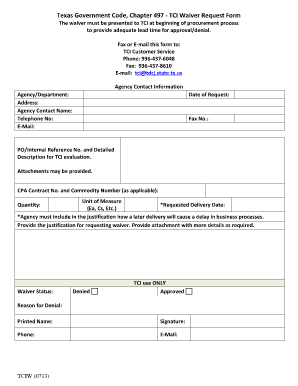

What are the types of Regulation E Model Disclosure Clauses and Form Templates?

There are several types of Regulation E Model Disclosure Clauses and Form Templates, including but not limited to:

How to complete Regulation E Model Disclosure Clauses and Form Templates

Completing Regulation E Model Disclosure Clauses and Form Templates is a straightforward process that involves filling in the relevant information as required. Follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.