Regulation E Pdf

What is Regulation E PDF?

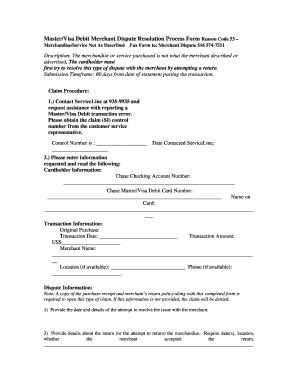

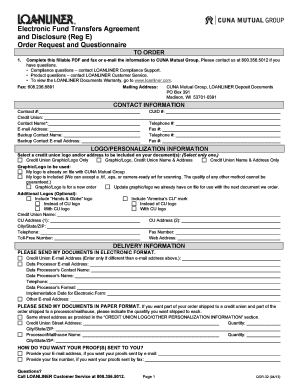

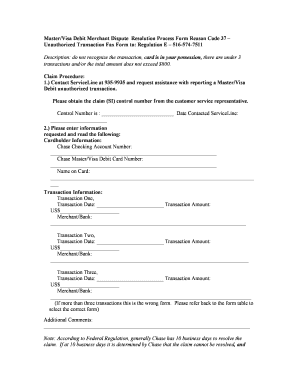

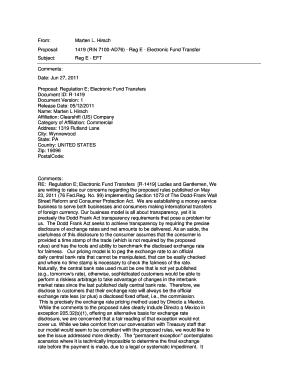

Regulation E PDF refers to a set of rules established by the Consumer Financial Protection Bureau to protect consumers in electronic transactions. It covers aspects such as error resolution, unauthorized transactions, and disclosures related to electronic transfers.

What are the types of Regulation E PDF?

The types of Regulation E PDF include:

Regulation E for consumers

Regulation E for financial institutions

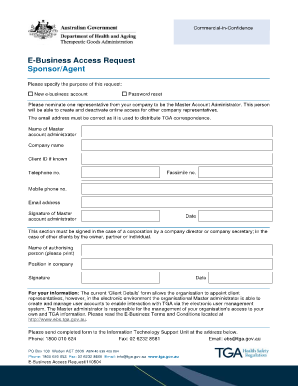

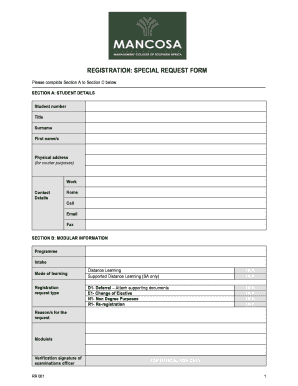

How to complete Regulation E PDF

Completing Regulation E PDF is easy with the following steps:

01

Fill in personal information accurately

02

Review all details carefully

03

Sign the document electronically if applicable

04

Save a copy for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Regulation e pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is regulation E disclosure?

Regulation E is a regulation put forth by the Federal Reserve Board that outlines rules and procedures for electronic funds transfers (EFTs) and provides guidelines for issuers of electronic debit cards. The regulation is meant to protect banking customers who use electronic methods to transfer money.

What is not covered by Reg E?

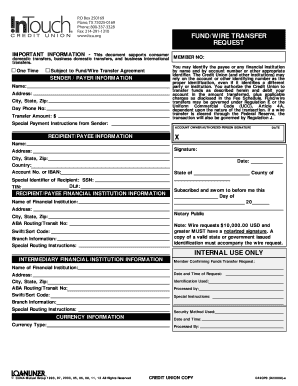

Regulation E covers transactions that affect funds in consumer bank accounts, which means it doesn't cover credit card transactions, checks or wire transfers. If you have an issue with unauthorized or mistaken use of your credit card, report it to your credit card issuer.

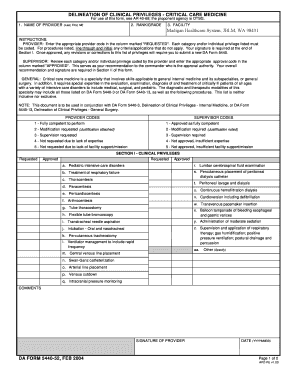

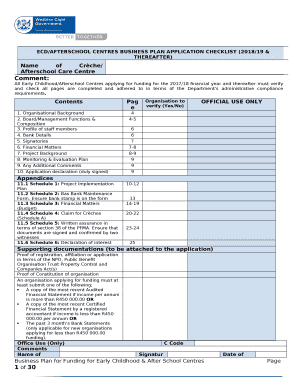

What are the requirements for regulation E?

These requirements include keeping track of consumer agreements, providing periodic statements, error resolution, reimbursement of fees incorrectly charged to the consumer, providing access to account information, disclosing a telephone number that the consumer can use to contact the financial institution, and so on.

What must regulation E disclosures be?

Required disclosures must be clear and readily understandable, in writing, and in a form the consumer may keep. The required disclosures may be provided to the consumer in electronic form, if the consumer affirmatively consents after receiving a notice that complies with the E- Sign Act (12 CFR 1005.4(a)(1)).

What is the regulation E?

Regulation E is a federal regulation that protects consumers against fraudulent and incorrect electronic fund transfers (EFTs) to or from their bank accounts.

What does Reg E require to be disclosed on a customer's periodic statement?

The periodic statement must contain: the amount of the transfer. the date the transfer was credited or debited to the account. the type of transfer and type of account to or from which the funds were transferred. and the name of any third party to or from whom the funds were transferred.