Donation Form Pdf

What is Donation form pdf?

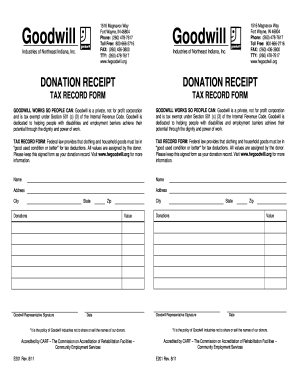

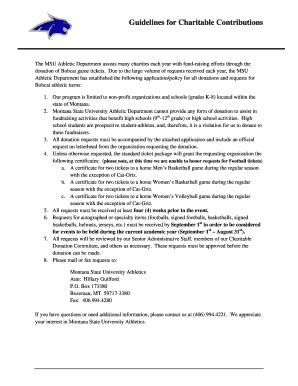

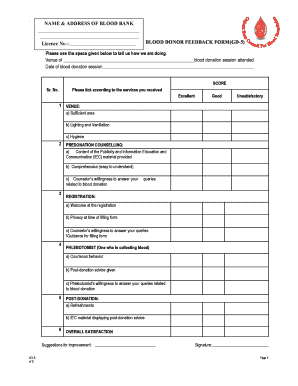

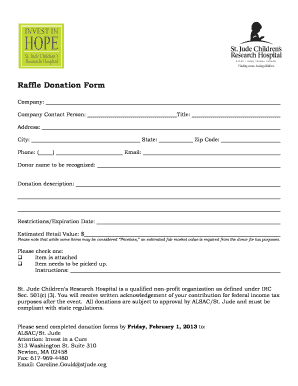

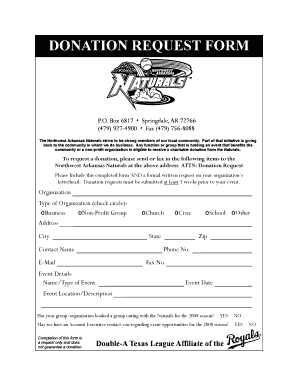

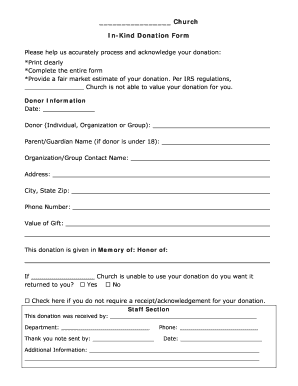

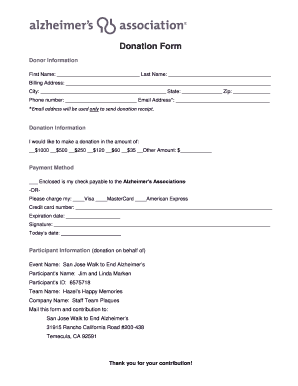

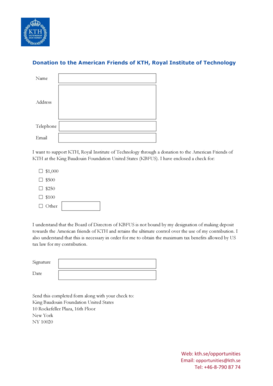

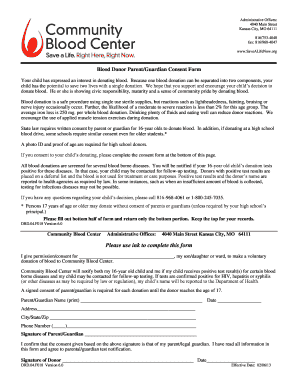

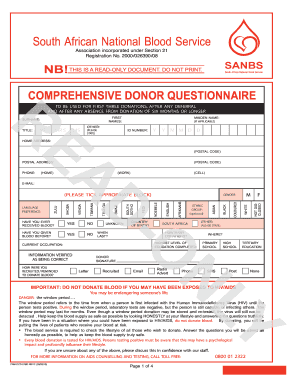

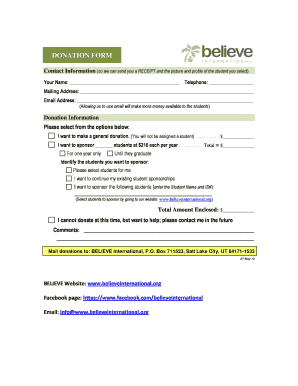

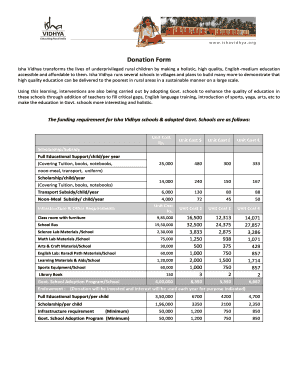

A Donation form pdf is a digital document that allows individuals or organizations to collect donations from supporters. It provides a convenient and secure way for donors to contribute to a cause or charity online.

What are the types of Donation form pdf?

There are several types of Donation form pdf templates available, including: 1. One-time donation form 2. Recurring donation form 3. In-memory donation form 4. In-honor donation form 5. Specific cause donation form 6. General donation form

One-time donation form

Recurring donation form

In-memory donation form

In-honor donation form

Specific cause donation form

General donation form

How to complete Donation form pdf

To successfully complete a Donation form pdf, follow these simple steps:

01

Download the Donation form pdf template

02

Open the pdfFiller website

03

Upload the template to the pdfFiller editor

04

Fill in the required information

05

Save or share the completed form

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor you need to get your donation forms done efficiently.

Video Tutorial How to Fill Out Donation form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I report donations to charity on my tax return?

To claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing Schedule A of IRS Form 1040.

Does IRS need proof of charitable donations?

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

What IRS form do I use for charitable donations?

Purpose of Form Use Form 8283 to report information about noncash charitable contributions. Do not use Form 8283 to report out-of-pocket expenses for volunteer work or amounts you gave by check or credit card. Treat these items as cash contributions.

What is the IRS rule for donations over $500?

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

What is a proof of donation letter?

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

How do I deduct charitable contributions without itemizing?

Can you take charitable tax deductions without itemizing? No, unlike the 2021 tax year, in order to take a tax deduction for your charitable contributions in 2023, your total deductions must exceed the standard deduction for your tax filing status.