Forms For Charitable Donations

What are Forms for charitable donations?

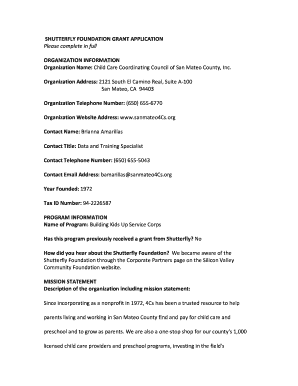

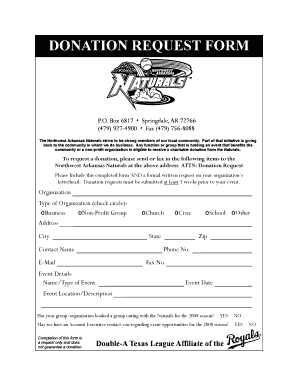

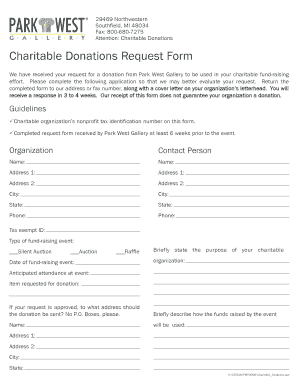

Forms for charitable donations are documents that allow individuals or organizations to make contributions to nonprofit or charitable organizations. These forms help ensure that donations are properly recorded and allocated for their intended purposes.

What are the types of Forms for charitable donations?

There are several types of Forms for charitable donations, including:

Cash donation forms

In-kind donation forms

Stock donation forms

Vehicle donation forms

How to complete Forms for charitable donations

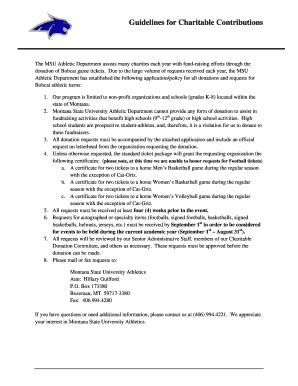

Completing Forms for charitable donations is a simple process that involves the following steps:

01

Gather all necessary information, including your personal details and the details of the donation

02

Fill out the form accurately and completely

03

Review the form for any errors or missing information before submission

pdfFiller is a valuable tool that empowers users to create, edit, and share charitable donation forms online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process of completing and submitting donation forms.

Video Tutorial How to Fill Out Forms for charitable donations

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

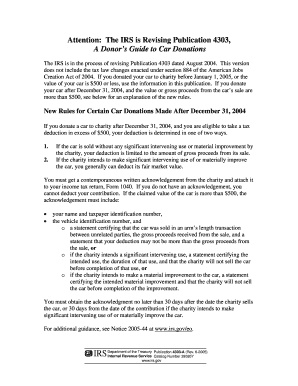

What IRS form do I use for charitable donations?

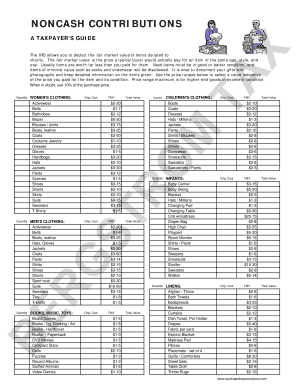

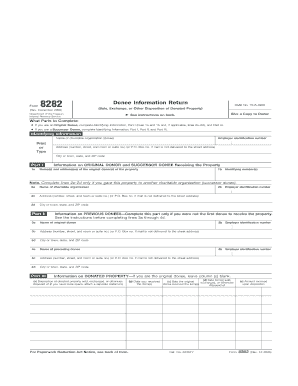

Purpose of Form Use Form 8283 to report information about noncash charitable contributions. Do not use Form 8283 to report out-of-pocket expenses for volunteer work or amounts you gave by check or credit card. Treat these items as cash contributions.

How do I deduct charitable contributions without itemizing?

Can you take charitable tax deductions without itemizing? No, unlike the 2021 tax year, in order to take a tax deduction for your charitable contributions in 2023, your total deductions must exceed the standard deduction for your tax filing status.

How do I report donations to charity on my tax return?

To claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing Schedule A of IRS Form 1040.

How much can you write off in charitable donations?

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

What are the three most common forms of charitable giving?

Here's what you need to know about the different types of charitable giving. Cash. Monetary donations are one of the simplest ways to contribute to a charity or nonprofit. Stocks & securities. Planned giving and charitable trusts. Valuable assets.

Does IRS need proof of charitable donations?

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.