Donation Form Pdf

What is Donation form pdf?

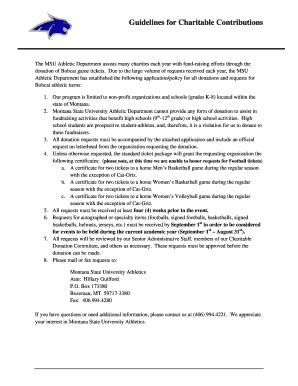

Donation form pdf is a digital document used to collect information and donations from individuals or organizations. It allows for easy completion and submission of donation details online.

What are the types of Donation form pdf?

There are several types of Donation form pdf templates available, including:

One-time donation form

Monthly donation form

In-kind donation form

Pledge form

How to complete Donation form pdf

Completing a Donation form pdf is simple and easy. Just follow these steps:

01

Open the pdfFiller website

02

Select the desired Donation form pdf template

03

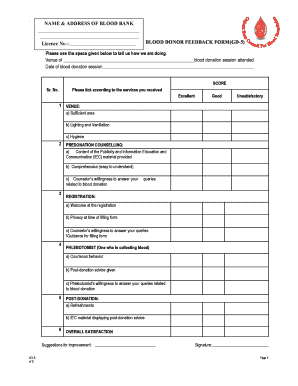

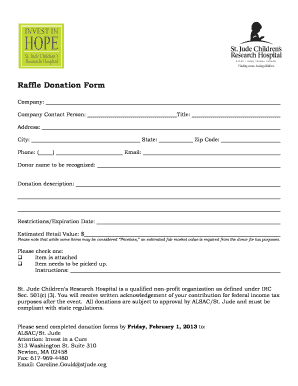

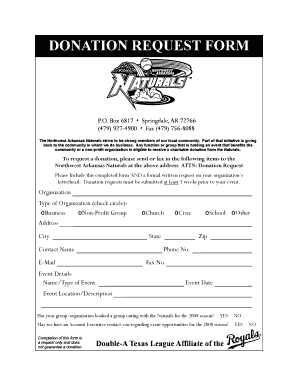

Fill in the required information such as name, donation amount, and payment details

04

Review the form for accuracy

05

Save or share the completed form

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What if my charitable donations are more than 500?

Over $500 to $5,000: Contemporaneous written acknowledgment and you must file Form 8283 with your tax return. 12. Over $5,000: Contemporaneous written acknowledgment, a written appraisal of the property from a qualified appraiser, and filing Form 8283 with your tax return. 13.

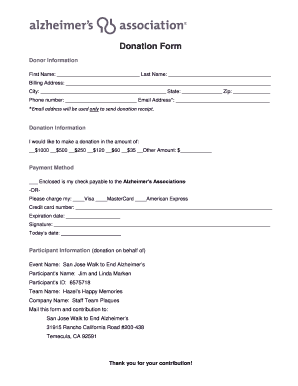

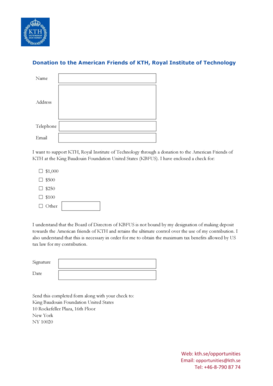

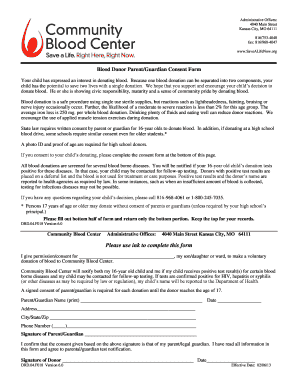

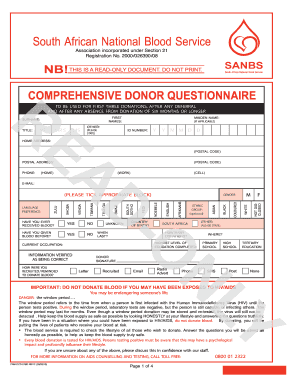

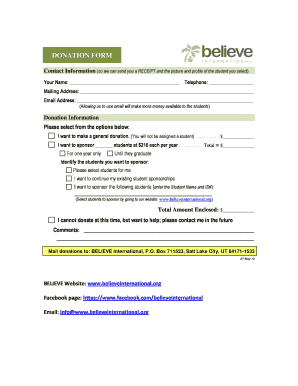

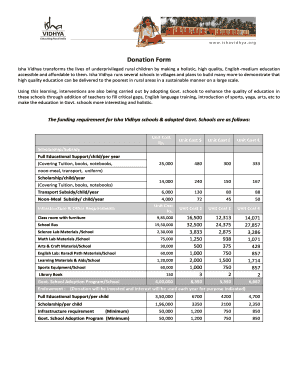

What should a donation form include?

What's included in a nonprofit donation form template Branded form. For a basic form, without any additional messaging or imagery, it's important to brand the experience. Gift amount. Recurring gift option. Personal information. Payment information. Donor-covered fees option. Thank you message.

Is there an IRS limit on charitable donations?

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply. Table 1 gives examples of contributions you can and can't deduct.

What is a proof of donation letter?

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

How much donation can you write off on your taxes?

How much can you donate to charity for a tax deduction? Generally, itemizers can deduct 20% to 60% of their adjusted gross income for charitable donations. The exact percentage depends on the type of qualified contribution as well as the charity or organization.

What are the IRS guidelines for donations?

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.