Church Budget Forms Pdf

What is Church budget forms pdf?

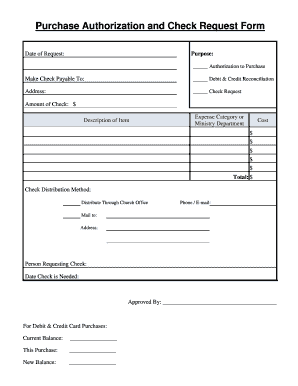

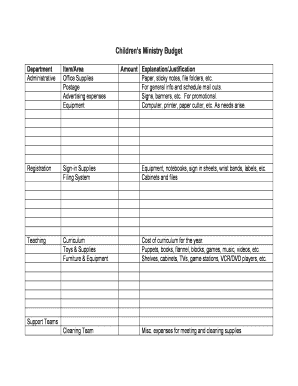

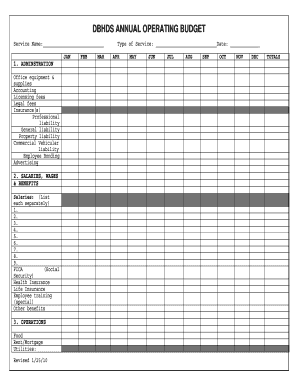

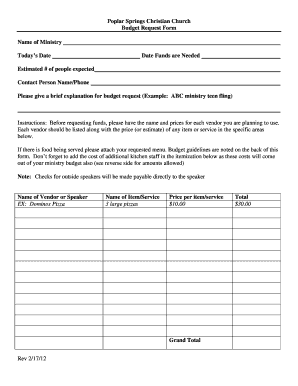

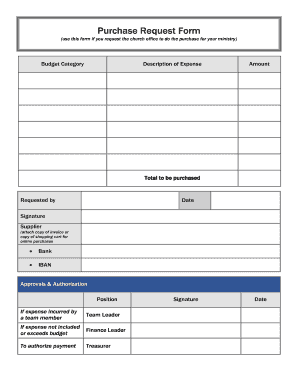

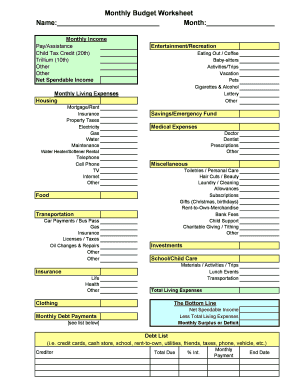

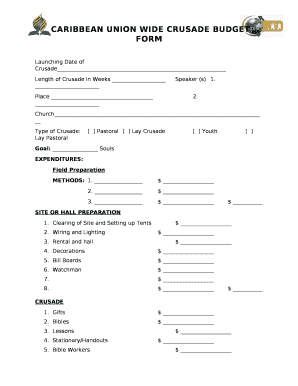

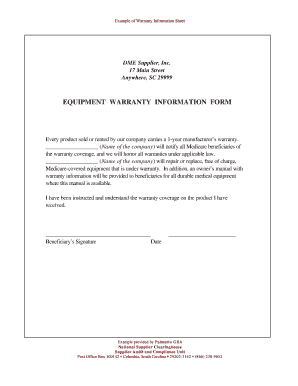

Church budget forms pdf refer to the templates designed specifically for churches to plan and track their finances effectively. These forms typically include sections for income, expenses, donations, and budget goals.

What are the types of Church budget forms pdf?

There are various types of Church budget forms pdf available to cater to different needs and preferences. Some common types include:

Monthly budget forms

Annual budget forms

Donation tracking forms

Expense tracking forms

How to complete Church budget forms pdf

Completing Church budget forms pdf is a straightforward process that can help you gain better control over your finances. Here are some steps to guide you:

01

Start by filling in your church's name, address, and contact information

02

Detail all sources of income, including donations, offerings, and grants

03

List out all expenses such as rent, utilities, salaries, and ministry costs

04

Set budget goals for different categories to ensure financial stability

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Church budget forms pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you create a budget draft?

How to Make a Budget in 5 Steps Step 1: List Your Income. Step 2: List Your Expenses. Step 3: Subtract Expenses From Income. Step 4: Track Your Expenses (All Month Long) Step 5: Make a New Budget Before the Month Begins.

What is the ideal budget percentage for a church?

Using 46% to 60% of the church's budget on total compensation is a “normal” range for most churches. However, when you combine the level of salary compared to the market and the church's budget, you create a great barometer of financial health.

How do you draft a church budget?

Below is a list of the most common areas that must be covered in your church budget. Income. Keep track of all income your church receives — including online donations and other fundraising channels. Personnel. Administration. Facilities and equipment. Direct ministry. Outreach. Church expansion. Reserves for the future.

What are the budget categories for churches?

On the other hand, if your church is established and you own your building, then you can allocate a majority of your funds to outreach. Income. Personnel. Administration. Facilities and Equipment. Outreach. Direct Ministry. Church expansion expenses. Debt.

How much do you give a pastor?

When it comes to donations, this can either be a monetary donation, with $150-$200 often being the most common, or a gift. Gifts can come in a wide range of methods, and your pastor might tell you what the church needs most, ensuring you can provide their congregation with exactly what they need.

How do I create a simple budget template?

How to create a budget spreadsheet Choose a spreadsheet program or template. Create categories for income and expense items. Set your budget period (weekly, monthly, etc.). Enter your numbers and use simple formulas to streamline calculations. Consider visual aids and other features.