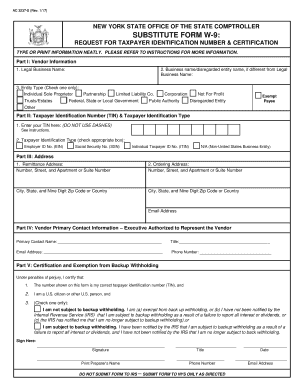

Company Requesting W-9 - Page 2

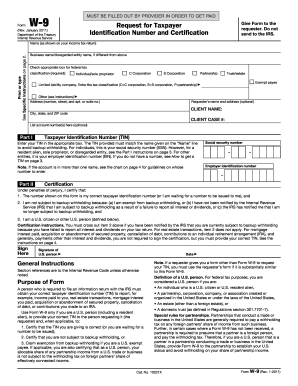

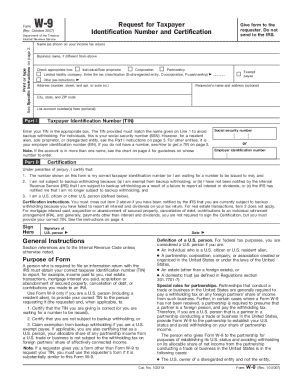

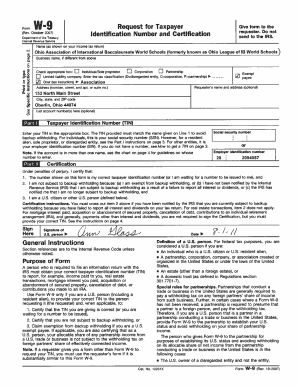

What is Company requesting W-9?

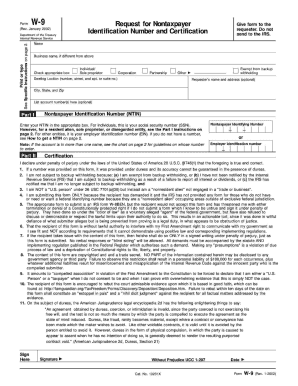

When a company requests a W-9 form from you, they are asking for your taxpayer identification number (TIN) for tax reporting purposes. This form helps them verify your identity and report any payments made to you to the IRS.

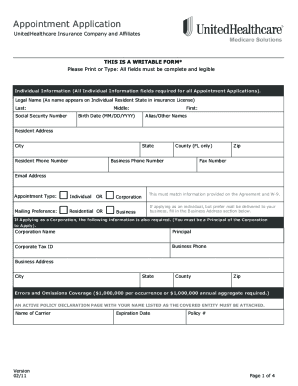

What are the types of Company requesting W-9?

There are different types of companies that may request a W-9 form from you, including employers, clients, and financial institutions. Some examples of companies that may ask for a W-9 form include freelance clients, rental property managers, and banks.

How to complete Company requesting W-9

To complete a W-9 form for a company requesting it, follow these simple steps:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.