Get the free W-9 Form - University of Missouri Extension - extension missouri

Show details

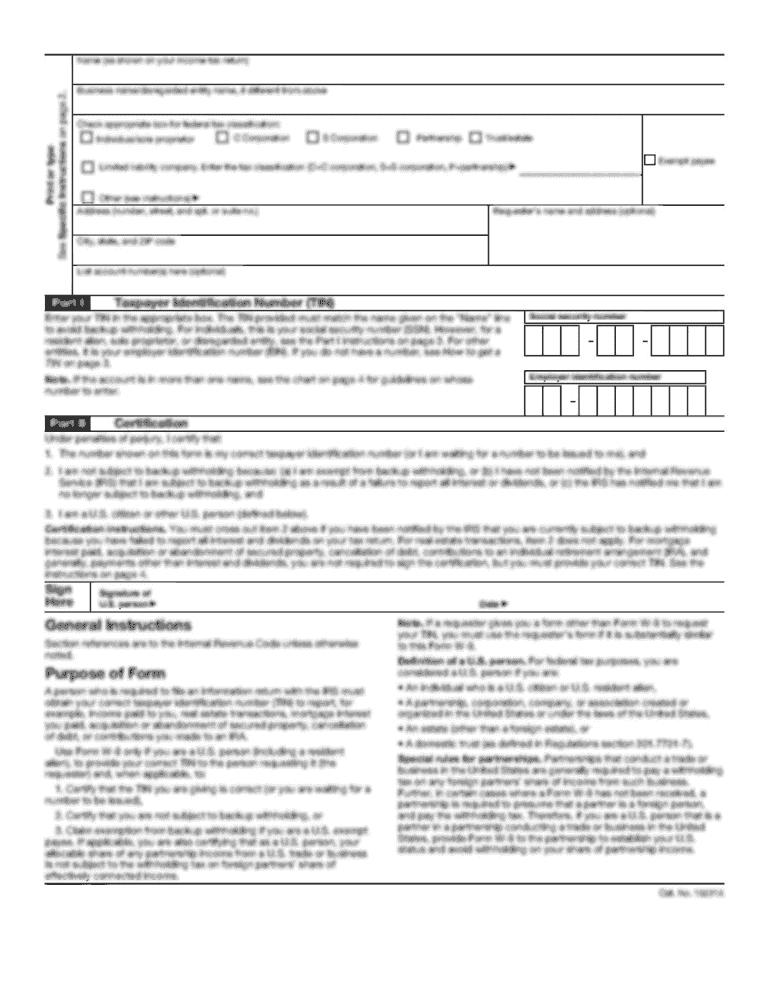

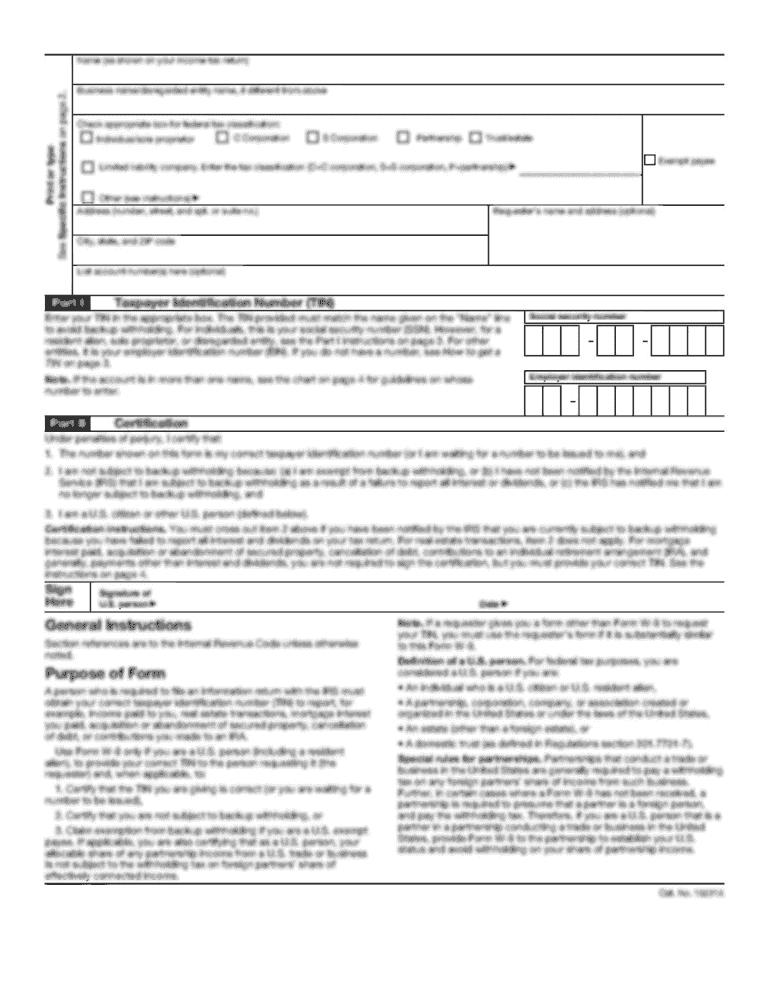

County Accounting Manual W-9 Form Request for Employer Identification Number and Certification Contents: The IRS W-9 form is requested from a company or organization that makes payments to the Extension

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w-9 form - university form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-9 form - university form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w-9 form - university online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit w-9 form - university. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out w-9 form - university

How to fill out w-9 form - university:

01

Obtain the w-9 form from the Internal Revenue Service (IRS) website or from your university's financial department.

02

Fill in the designated spaces with the name of the university. This should be entered in the "Name" field.

03

Provide the university's business address in the "Address" field. Make sure to include the street, city, state, and ZIP code.

04

Enter the university's taxpayer identification number (TIN) in the "Taxpayer Identification Number" field. This can either be the employer identification number (EIN) or the social security number (SSN) of the university.

05

Indicate the type of taxpayer classification for the university in the "Exemptions" section. Most universities fall under the category of "Exempt payee" and do not need to fill out Part II of the form.

06

Sign and date the form. If you are authorized to sign on behalf of the university, enter your title or capacity in the "Capacity" field.

07

Submit the completed w-9 form to the appropriate entity that requested it, such as a vendor, contractor, or other organization requiring the university's information for tax purposes.

Who needs w-9 form - university:

01

Universities may need to fill out a w-9 form when they are required to provide their taxpayer information to other entities, such as vendors, contractors, or financial institutions.

02

For example, if a university is hiring a contractor to perform services, they may be asked to submit a w-9 form to provide their taxpayer identification information for tax reporting purposes.

03

Additionally, financial institutions may require universities to complete a w-9 form when opening new accounts or engaging in certain financial transactions that require tax reporting.

04

As a general rule, any situation that involves payments or financial transactions where the university's taxpayer identification information is required may necessitate the completion of a w-9 form.

05

It is important for universities to comply with these requests in order to ensure accurate tax reporting and maintain legal and financial compliance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w-9 form - university?

The W-9 form for universities is a form used to provide taxpayer identification numbers to payees, such as contractors or vendors, for tax reporting purposes.

Who is required to file w-9 form - university?

Vendors, contractors, and other individuals or entities who receive payments from the university are required to file a W-9 form.

How to fill out w-9 form - university?

To fill out a W-9 form for a university, individuals or entities must provide their name, address, taxpayer identification number, and certify their taxpayer status.

What is the purpose of w-9 form - university?

The purpose of the W-9 form for universities is to collect taxpayer identification numbers for tax reporting and compliance.

What information must be reported on w-9 form - university?

The information reported on a W-9 form for a university includes the recipient's name, address, taxpayer identification number, and certification of their taxpayer status.

When is the deadline to file w-9 form - university in 2023?

The deadline to file a W-9 form for a university in 2023 is typically before payments are made to the recipient or vendor.

What is the penalty for the late filing of w-9 form - university?

The penalty for late filing of a W-9 form for a university may vary, but typically can result in fines or penalties imposed by the IRS.

How can I send w-9 form - university to be eSigned by others?

To distribute your w-9 form - university, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in w-9 form - university without leaving Chrome?

w-9 form - university can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out w-9 form - university on an Android device?

Use the pdfFiller mobile app to complete your w-9 form - university on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your w-9 form - university online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.