First-tier Tribunal (tax) - Page 2

What is First-tier tribunal (tax)?

The First-tier tribunal (tax) is an independent body that hears appeals on decisions made by HM Revenue and Customs regarding tax issues. It provides taxpayers with a fair and impartial review process for disputes over tax assessments or penalties.

What are the types of First-tier tribunal (tax)?

There are several types of First-tier tribunal (tax) that deal with different tax-related issues. Some common types include:

Income tax appeals

Corporation tax disputes

VAT disputes

Inheritance tax appeals

Capital gains tax disputes

How to complete First-tier tribunal (tax)

Completing the First-tier tribunal (tax) process is a straightforward task with the following steps:

01

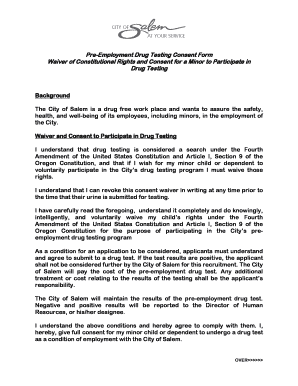

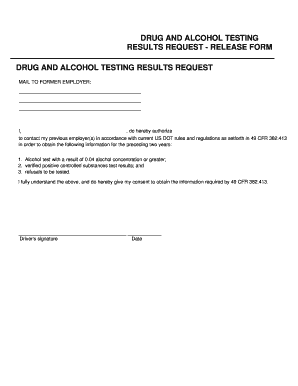

Gather all relevant documents and evidence to support your appeal.

02

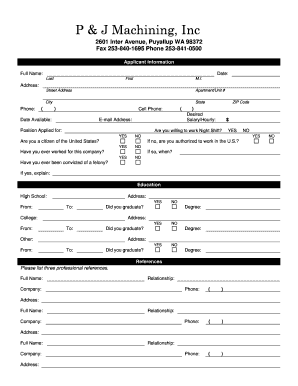

Fill out the necessary forms and submit them to the tribunal.

03

Attend the tribunal hearing and present your case to the tribunal panel.

04

Await the tribunal's decision and follow any instructions or orders given.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out First-tier tribunal (tax)

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the first tier tribunal in the UK?

The seven Chambers of the First-tier Tribunal deal with disputes in a number of diverse areas of the law including Tax, Immigration and Asylum and Health, Education and Social Care.

What is a tax tribunal in UK?

Responsible for handling appeals against some decisions made by HMRC relating to income tax, PAYE tax, corporation tax, capital gains tax, national insurance contributions, statutory sick pay, statutory maternity pay, inheritance tax, VAT, excise duty and customs duty.

What is first tier tribunal tax UK?

Responsible for handling appeals against some decisions made by HMRC relating to income tax, PAYE tax, corporation tax, capital gains tax, national insurance contributions, statutory sick pay, statutory maternity pay, inheritance tax, VAT, excise duty and customs duty.

What is the UK Upper Tribunal?

What we do. We're responsible for dealing with appeals against decisions made by certain lower tribunals and organisations including: social security and child support. war pensions and armed forces compensation.

What is the First Tier Tribunal Immigration and Asylum Chamber?

The First-tier Tribunal Immigration and Asylum Chamber are responsible for handling appeals against some decisions made by the Home Office relating to: permission to stay in the UK. deportation from the UK. entry clearance to the UK.

What is the tax tribunal in the UK?

The Tax Tribunal is completely independent of HMRC and is governed by an overriding objective to deal with cases fairly and justly (rule 2, First Tier Tribunal Rules (FTR 2009)). The Tribunal will consider the evidence of both parties, equally whilst the judge heavily relies on previous case law.