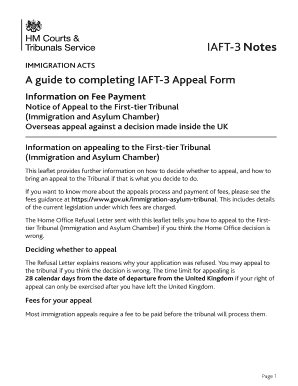

First-tier Tax Tribunal Rules

What is First-tier tax tribunal rules?

First-tier tax tribunal rules refer to the guidelines and procedures followed by the First-tier Tax Tribunal when handling tax-related disputes. These rules ensure a fair and consistent approach to resolving tax issues between taxpayers and tax authorities.

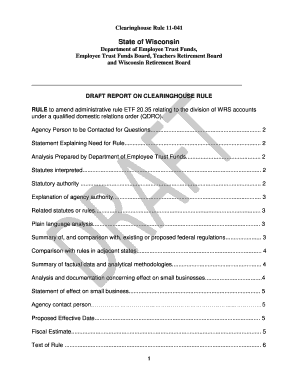

What are the types of First-tier tax tribunal rules?

There are several types of First-tier tax tribunal rules that govern different aspects of the tribunal's process. Some common types include:

Administrative rules

Procedural rules

Evidence rules

Appeal rules

How to complete First-tier tax tribunal rules

To successfully complete First-tier tax tribunal rules, follow these steps:

01

Review the specific rules applicable to your case

02

Prepare your evidence and supporting documentation

03

Adhere to deadlines and procedures outlined in the rules

04

Seek legal advice if necessary

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out First-tier tax tribunal rules

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

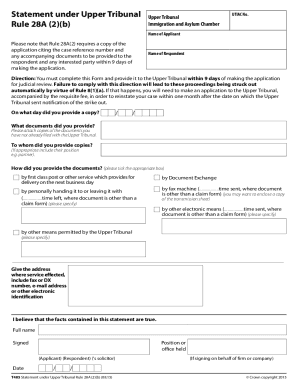

What is the Upper Tribunal UK?

What we do. We're responsible for dealing with appeals against decisions made by certain lower tribunals and organisations including: social security and child support. war pensions and armed forces compensation.

What is the purpose of the Upper Tribunal?

Deals with appeals against decisions made by lower tribunals and organisations including: social security and child support, war pensions and armed forces compensation, mental health, special education needs or disabilities and disputes heard by the General Regulatory Chamber.

What is the first-tier tribunal England?

The First-tier Tribunal (Property Chamber) has 5 regional offices throughout England that deal with settling of disputes in relation to leasehold property and the private rented sector.

What is the FTT in the UK?

The FTT is a part of the court system in the UK but is independent of the government. There are currently five regionally based tribunal offices. Each tribunal usually consists of 3 members who hear your case including a chairman (normally a solicitor), a surveyor and a layperson.

Who sits in the upper tribunal?

The holders of judicial office in the Upper Tribunal, Lands Chamber are its Chamber President, who leads the Chamber and who is a High Court Judge. the Deputy Chamber President, who assists the President in the management of the Chamber. one further Upper Tribunal Judge. three Members of the Upper Tribunal (who are

What is first-tier tribunal tax UK?

Responsible for handling appeals against some decisions made by HMRC relating to income tax, PAYE tax, corporation tax, capital gains tax, national insurance contributions, statutory sick pay, statutory maternity pay, inheritance tax, VAT, excise duty and customs duty.