Chapter 7 Bankruptcy

What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is a legal process that allows individuals or businesses to discharge most of their debts by selling off assets to pay creditors. This type of bankruptcy offers a fresh start to those overwhelmed by debt and unable to repay it.

What are the types of Chapter 7 bankruptcy?

There is only one type of Chapter 7 bankruptcy, which is the standard liquidation bankruptcy. In this type, the debtor's assets are sold off to pay creditors, and any remaining debts are discharged. It is a common choice for individuals and businesses seeking to eliminate overwhelming debt.

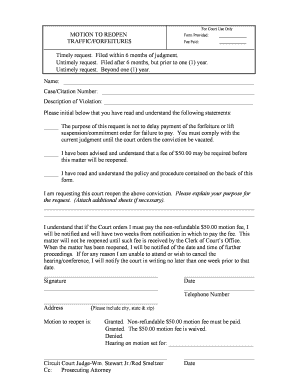

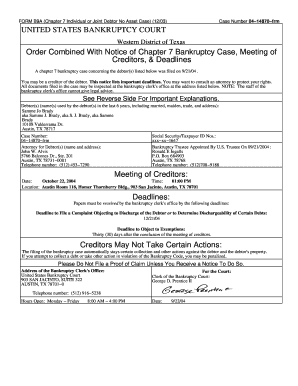

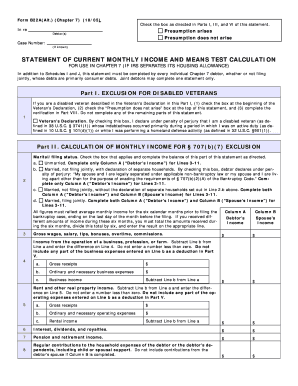

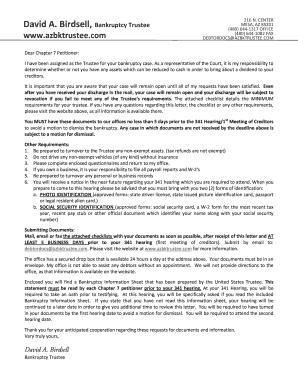

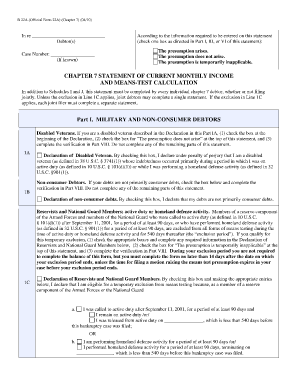

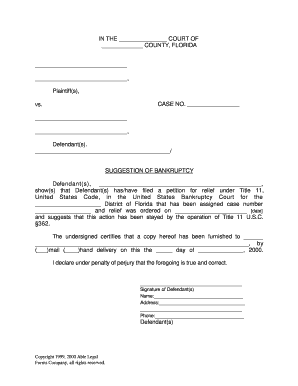

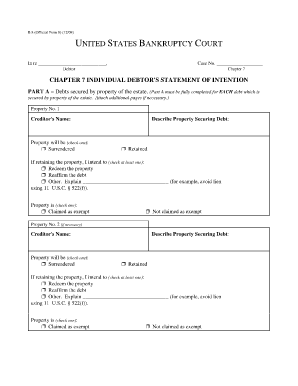

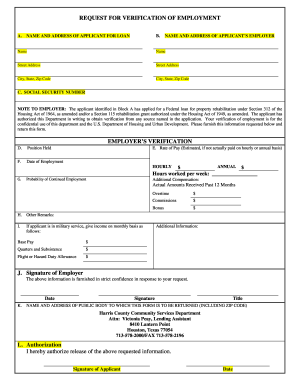

How to complete Chapter 7 bankruptcy

Completing Chapter 7 bankruptcy involves several steps to successfully discharge your debts and get a fresh financial start. Here are the key steps to complete Chapter 7 bankruptcy:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor you need to get your documents done swiftly and efficiently.