Home Insurance Quote Sheet Template - Page 2

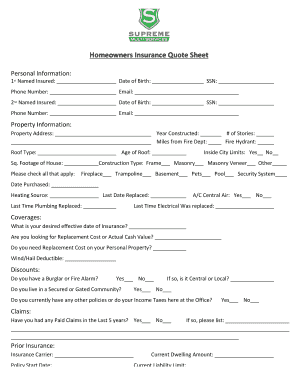

What is Home insurance quote sheet template?

A Home insurance quote sheet template is a document used by insurance companies to collect essential information about a property and its owners in order to generate accurate insurance quotes. It includes details such as property address, coverage amounts, and personal information of the insured parties.

What are the types of Home insurance quote sheet template?

There are several types of Home insurance quote sheet templates available, each tailored to specific needs and requirements. Some common types include:

How to complete Home insurance quote sheet template

Completing a Home insurance quote sheet template is crucial to ensure accurate insurance coverage. Follow these steps to complete the template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.