Fillable Insurance Forms

What is Fillable insurance forms?

Fillable insurance forms are digital documents that can be completed, edited, and signed electronically. They offer a convenient way for users to input information and submit insurance-related data without the need for printing and scanning.

What are the types of Fillable insurance forms?

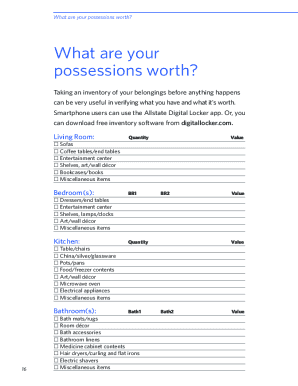

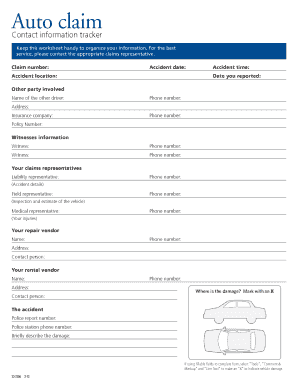

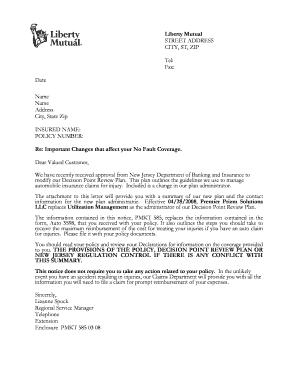

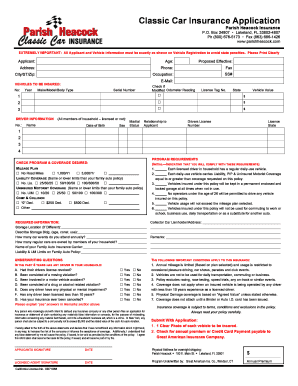

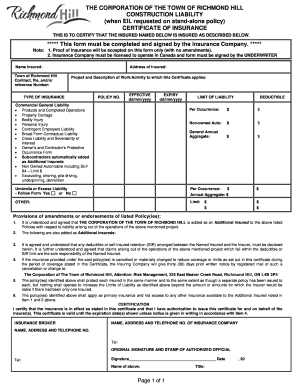

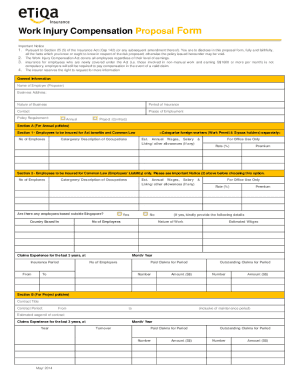

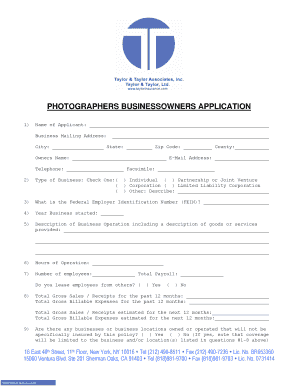

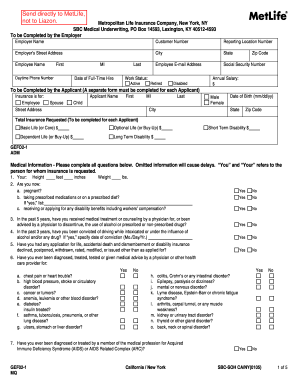

There are various types of Fillable insurance forms available, including but not limited to:

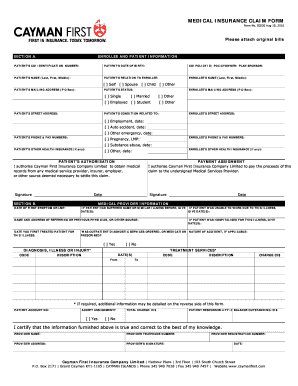

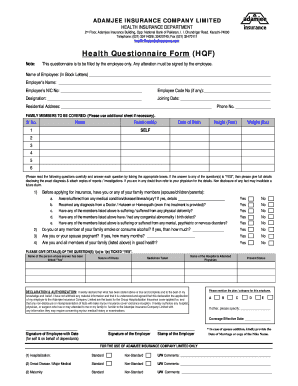

Health insurance claim forms

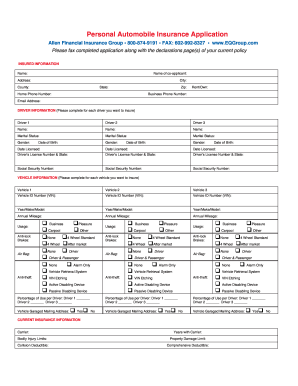

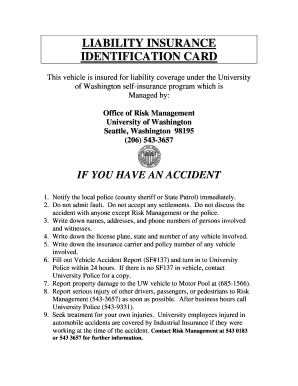

Auto insurance application forms

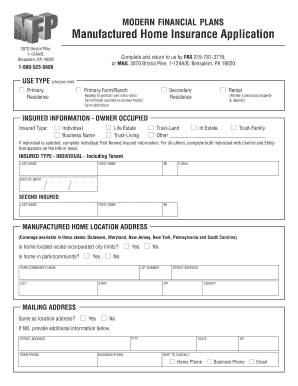

Home insurance policy forms

Life insurance beneficiary designation forms

How to complete Fillable insurance forms

Completing Fillable insurance forms is easy and efficient with the help of online tools like pdfFiller. Here are some steps to guide you through the process:

01

Access the Fillable insurance form online

02

Click on the fields to fill in your information

03

Use the editing tools to customize the form as needed

04

Save and share the completed form electronically

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fillable insurance forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a life insurance policy number?

Policy number - The unique number given to your life insurance contract. The policy type - This will say whether it is term life insurance or permanent life insurance and more specific information, such as 10-year term, universal life, etc.

What is a policy form number?

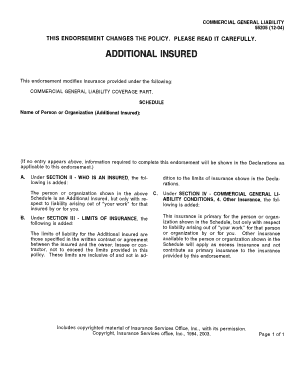

A policy form number is a code that an insurance company gives to a policyholder to provide them a means of individual identification. If the policyholder files a claim, the insurer will verify the policy form before compensating the insured.

What is basic coverage form?

Basic coverage is a “Named Peril” policy, which means that for a loss to be covered, the peril must be listed by name on the declarations page. In addition, you carry the burden of proving that a loss was caused by an included peril. Basic Form is typically the cheapest of the three coverage options.

What is an example of insurance coverage?

The most common types of insurance coverage include auto insurance, life insurance and homeowners insurance. Insurance coverage helps consumers recover financially from unexpected events, such as car accidents or the loss of an income-producing adult supporting a family.

Is there a Texas Department of Insurance?

The Texas Department of Insurance regulates the state's insurance industry, oversees the administration of the Texas workers' compensation system, performs the duties of the State Fire Marshal's Office, and provides administrative support to the Office of Injured Employee Counsel – a separate agency.

What is a policy form?

Policy form means the insurance contract language, including the declaration or information page, any endorsements or other contract language that constitute the contractual agreement between an insurer and its policyholder. Sample 1Sample 2.