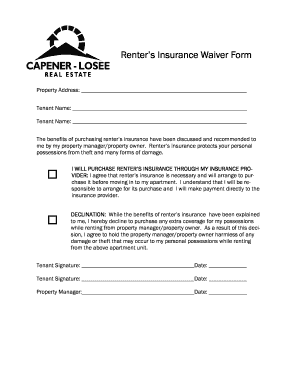

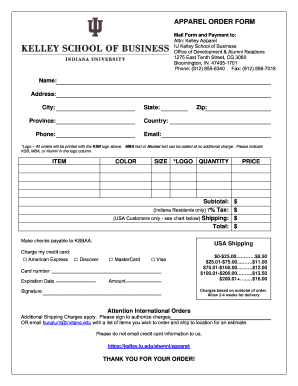

Insurance Form Example - Page 2

What is Insurance form example?

An insurance form is a document that captures essential details about an insurance policy. It includes information such as the policyholder's name, policy number, coverage details, and premium payments.

What are the types of Insurance form example?

There are various types of insurance forms based on the type of insurance policy. Some common examples include: health insurance claim forms, auto insurance application forms, home insurance policy forms, and life insurance beneficiary designation forms.

How to complete Insurance form example

Completing an insurance form is easy with pdfFiller. Simply follow these steps: 1. Create a pdfFiller account. 2. Choose the insurance form template you need. 3. Fill in the required information accurately. 4. Edit and customize the form as needed. 5. Share the completed form with the relevant party seamlessly.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.