Pci Compliant Credit Card Authorization Form

What is Pci compliant credit card authorization form?

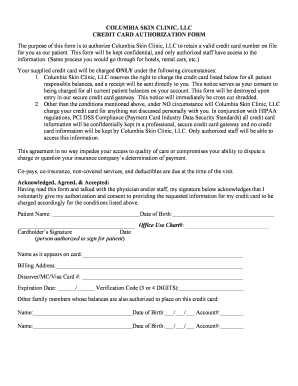

A Pci compliant credit card authorization form is a document that ensures businesses collecting credit card information adhere to Payment Card Industry Data Security Standard (PCI DSS) guidelines. This form protects both consumers' sensitive information and businesses from potential data breaches.

What are the types of Pci compliant credit card authorization form?

There are two primary types of Pci compliant credit card authorization forms:

Standalone Authorization Form

Integrated Authorization Form

How to complete Pci compliant credit card authorization form

Completing a Pci compliant credit card authorization form is simple and important for ensuring secure transactions. Here are the steps to follow:

01

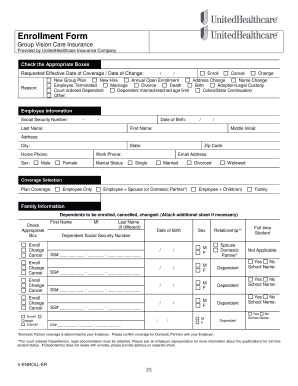

Fill in the cardholder's name and contact information

02

Provide the credit card details, including card number, expiration date, and CVV

03

Sign and date the form to authorize the transaction

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Pci compliant credit card authorization form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Are credit card authorization forms legal?

Credit card authorization forms are a best practice for merchants. Although it's not legally required, you should ask your lawyer when they would suggest using one.

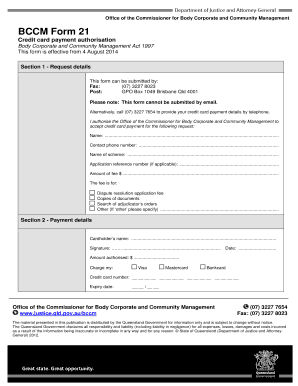

How to fill credit card payment authorization form?

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

Should I fill out a credit card authorization form?

Credit card authorization forms are beneficial for both the consumer and the business. The main benefit for businesses is protecting them from fraud and chargebacks. A chargeback is a tool to help consumers get their money back from purchases that were never rendered or unauthorized transactions.

How to fill credit card authorization form?

The information on such a form must include: Cardholder's name. Card number. Card network (Visa, Mastercard, American Express, Discover, etc.) Card expiration date. Cardholder's billing zip code. Business name. Statement authorizing charges. Cardholder's signature and the date they signed.

How do I authorize a credit card payment?

Authorization is the first step when purchasing goods or services. The merchant sends a request to their acquirer, also called a credit card processor — PayPal, for example. The acquirer then submits a request to the credit card issuer.

What is a credit card authorisation form?

A credit card authorisation form is a document, signed by a cardholder, that grants a merchant permission to charge their credit card for a period of time as written in that document.