Loan Application Form Sample

What is Loan application form sample?

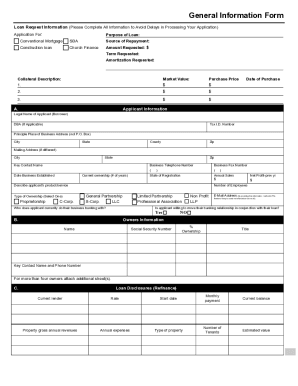

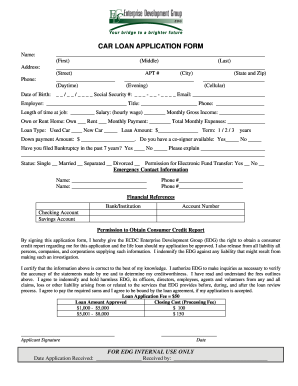

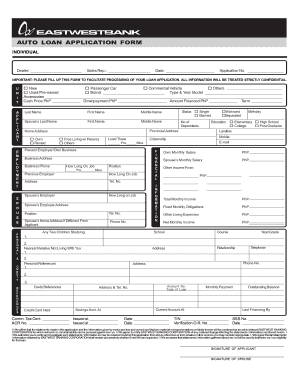

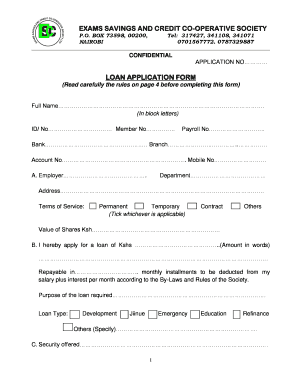

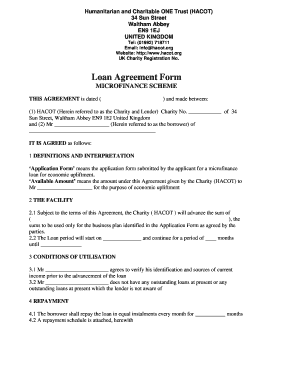

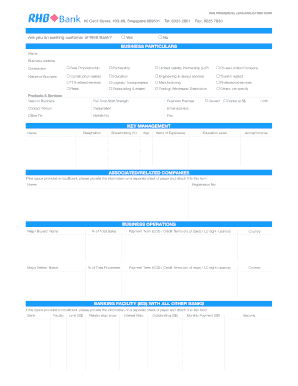

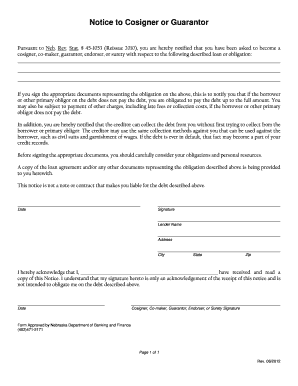

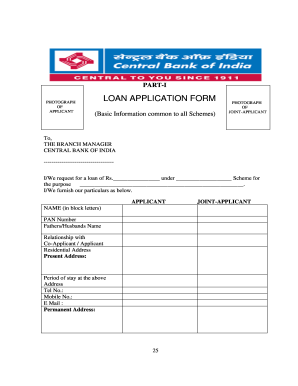

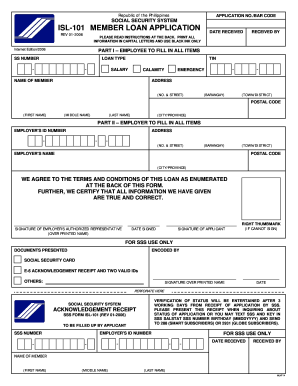

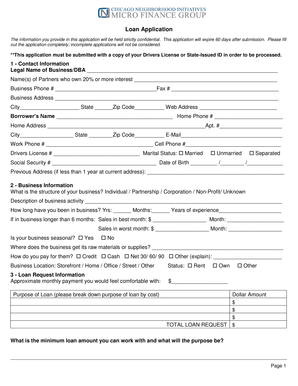

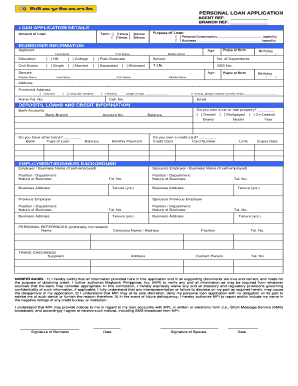

A Loan application form sample is a document that potential borrowers fill out to apply for a loan. It typically includes personal information, income details, and the loan amount requested.

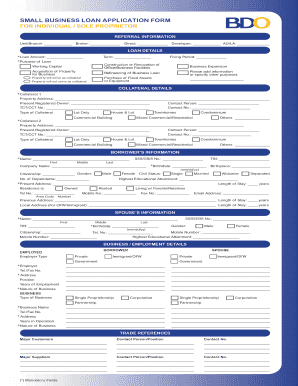

What are the types of Loan application form sample?

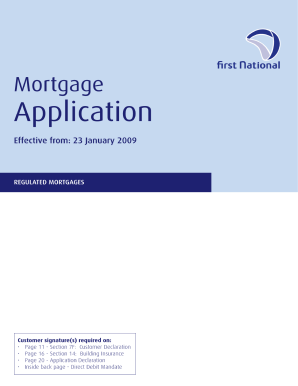

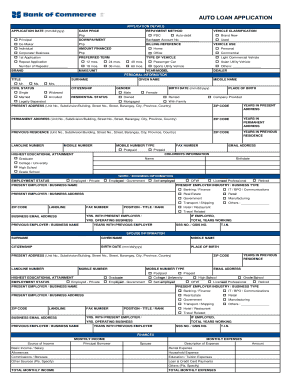

There are several types of Loan application form samples, including: 1. Mortgage loan application form 2. Personal loan application form 3. Business loan application form 4. Student loan application form 5. Auto loan application form

How to complete Loan application form sample

Completing a Loan application form sample is easy when you follow these steps: 1. Gather all required documents, such as proof of income and identification. 2. Fill out the form accurately with your personal and financial information. 3. Double-check all entries for accuracy and completeness before submitting.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.