Online Loan Application Form

What is Online loan application form?

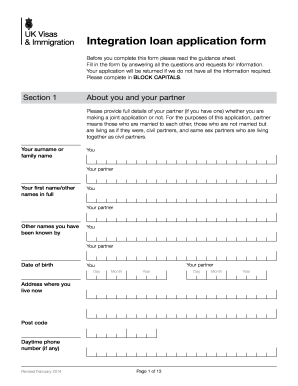

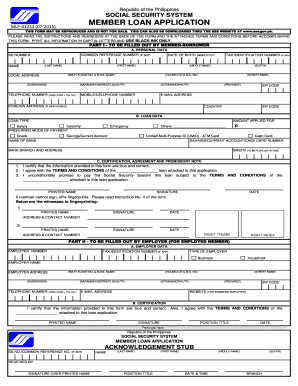

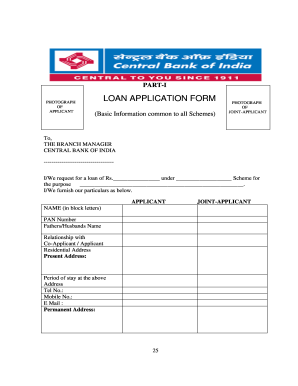

An online loan application form is a digital document that allows users to apply for various types of loans directly through a website or online platform. It eliminates the need for traditional paper forms and enables borrowers to fill out and submit their loan requests electronically.

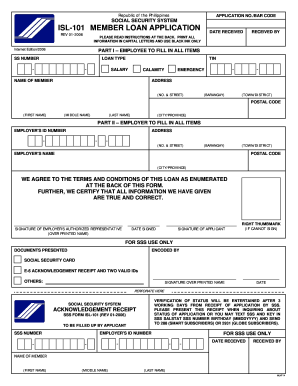

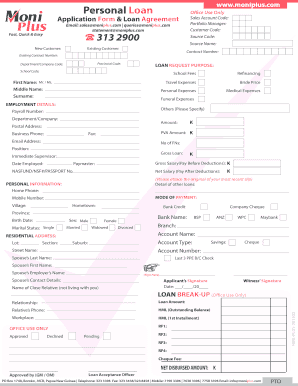

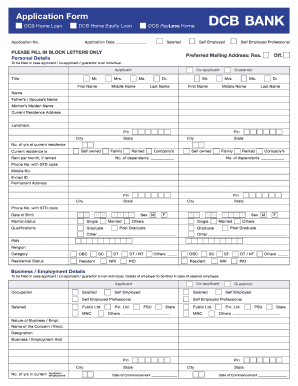

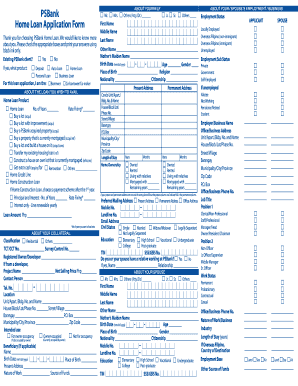

What are the types of Online loan application form?

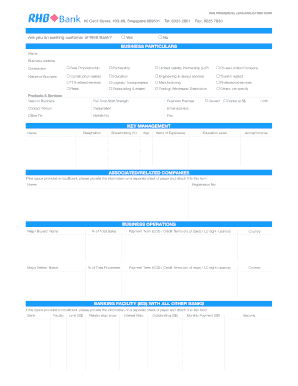

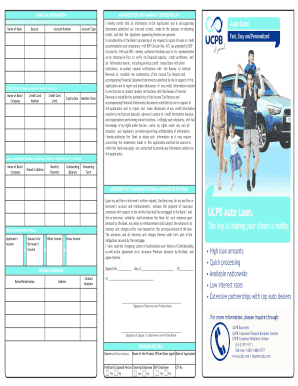

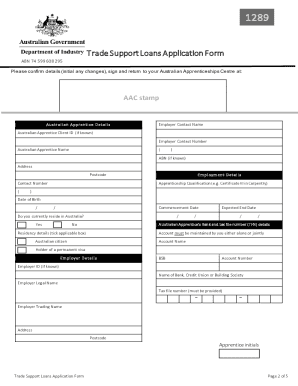

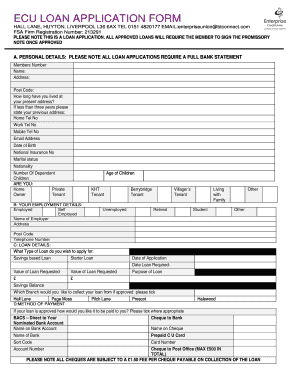

There are several types of online loan application forms tailored to different loan products and lenders. Some common types include:

How to complete Online loan application form

Completing an online loan application form is a straightforward process that can be done in a few simple steps. To successfully complete the form, follow these tips:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.