Equipment Rental Agreement Terms And Conditions

What is Equipment rental agreement terms and conditions?

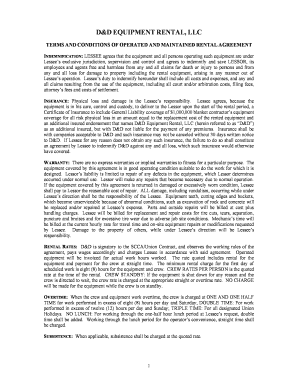

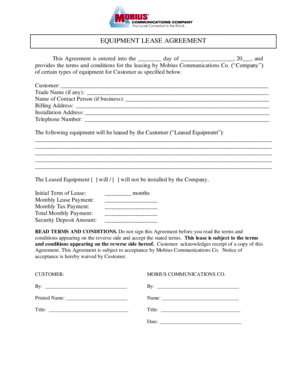

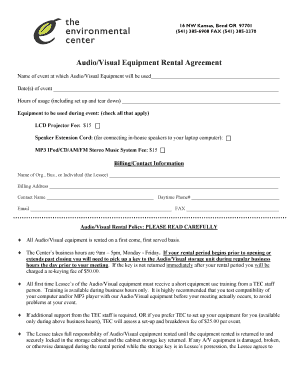

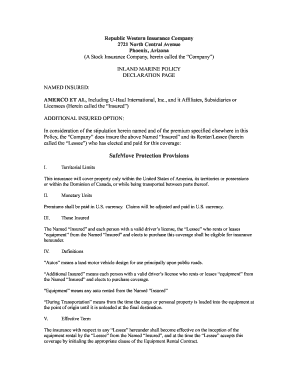

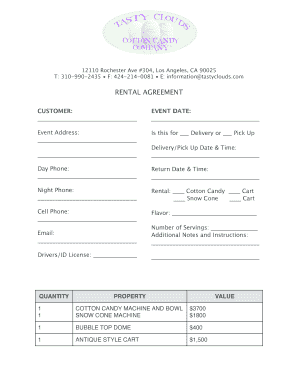

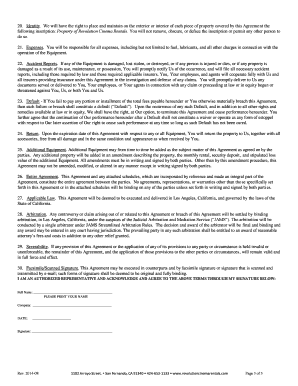

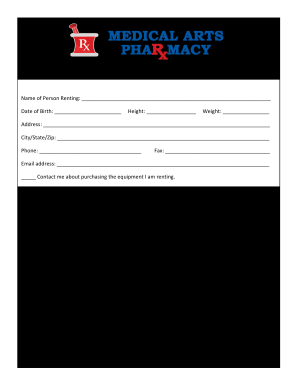

An Equipment rental agreement terms and conditions is a legal document that outlines the terms and conditions of renting equipment. It specifies the responsibilities of both the rental company and the renter regarding the use, maintenance, and return of the equipment.

What are the types of Equipment rental agreement terms and conditions?

There are several types of Equipment rental agreement terms and conditions, including:

Short-term rental agreements

Long-term rental agreements

Equipment maintenance agreements

How to complete Equipment rental agreement terms and conditions

To complete an Equipment rental agreement terms and conditions, follow these steps:

01

Read the agreement carefully to understand all terms and conditions.

02

Fill in all required fields with accurate information.

03

Sign the agreement electronically or in person, depending on the rental company's requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Equipment rental agreement terms and conditions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you write off leased equipment?

Deduct Lease Payments: Monthly payments may be deductible during the life of the lease. Section 179 Depreciation: 100% of the equipment may be deductible in the tax year it's acquired. Expense up to $1,050,000 of equipment acquired in 2021. $50,000 worth of equipment on a 36-month lease with FMV 10% purchase option.

What is an example of leased equipment?

For example, a manufacturer might lease a production machine under a capital lease because they'll use the equipment daily over a number of years. A company with a warehouse might lease forklifts for the same reason. Many capital leases allow the lessee to purchase the equipment at the end of the term.

How do you structure an equipment lease?

Components of an Equipment Lease Agreement Lease duration. The lease duration will depend on the company's needs and the cost of the equipment. Financial terms. Payment due to the lessor. Market value of equipment. Tax responsibility. Cancellation provisions. Lessee renewal options.

How to make money leasing equipment?

Most lessors earn profit through significant charges outside of the regular term rent stream, including interim rent, retained deposits, fees, lease extensions, non-compliant return charges, fair market value definitions, and end-of-lease buyouts for equipment that cannot be returned.

What is a equipment lease?

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Is it a good idea to lease equipment?

In general, leasing is probably the better choice if: You plan to use the piece of equipment for 36 months or less. You don't have cash on hand to make a down payment. The equipment becomes obsolete quickly.