Business Loan Application Form Sample Pdf

What is Business loan application form sample pdf?

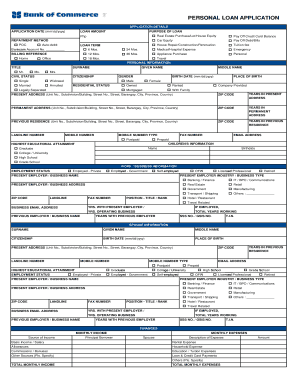

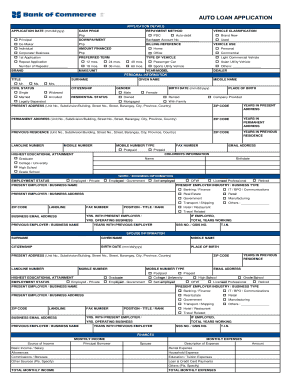

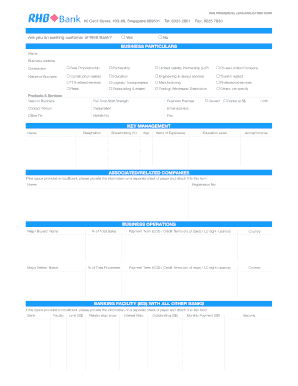

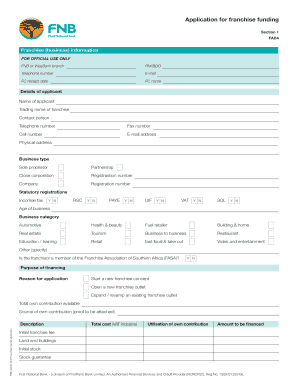

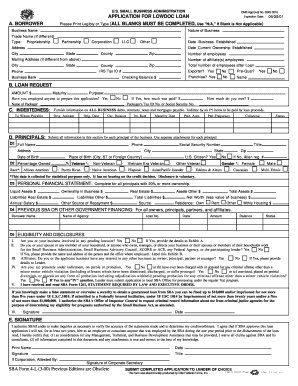

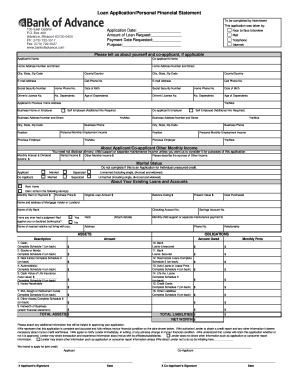

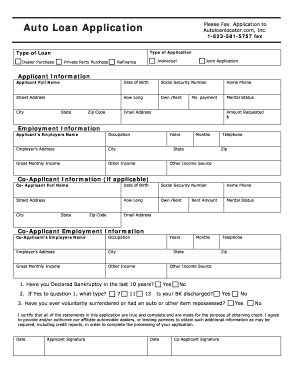

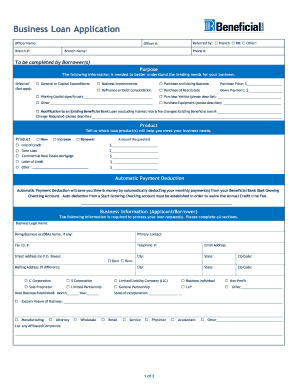

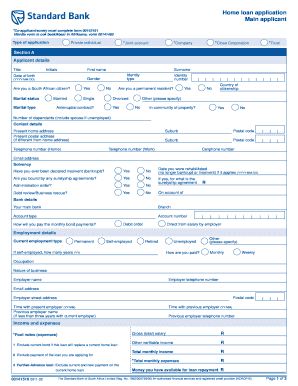

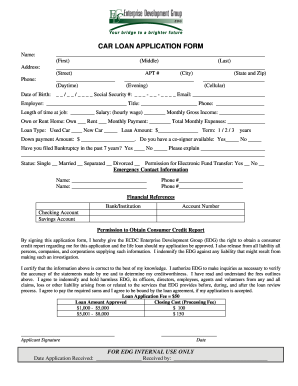

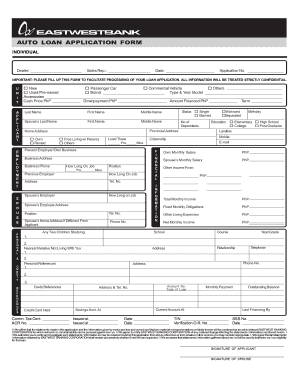

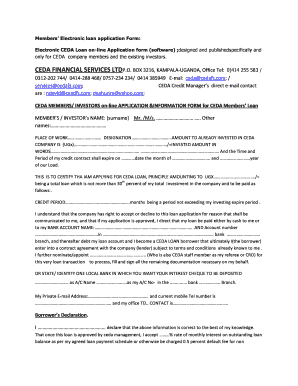

A Business loan application form sample pdf is a standardized document that financial institutions use to gather information from businesses applying for a loan. This form typically includes sections for company details, financial information, purpose of the loan, and terms of repayment.

What are the types of Business loan application form sample pdf?

There are several types of Business loan application form sample pdf, including: 1. Basic application form 2. Small business loan application form 3. Equipment or asset financing application form 4. Line of credit application form

How to complete Business loan application form sample pdf

Completing a Business loan application form sample pdf can seem overwhelming, but with these steps, it can be a smooth process: 1. Fill in company details accurately 2. Provide detailed financial information 3. Clearly state the purpose of the loan 4. Review and double-check all information before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.