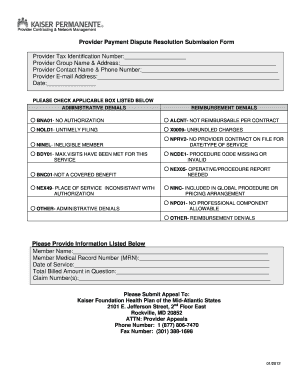

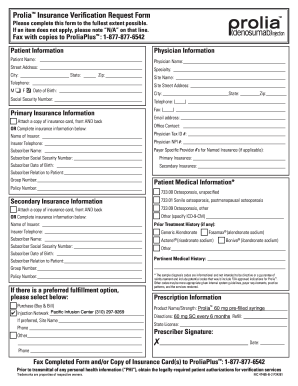

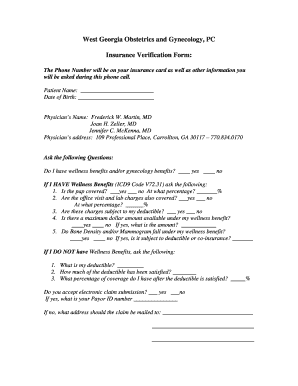

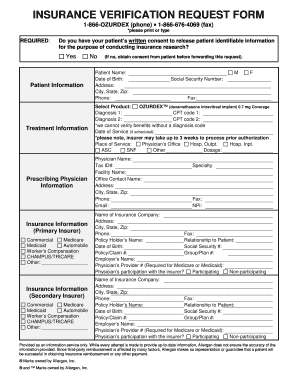

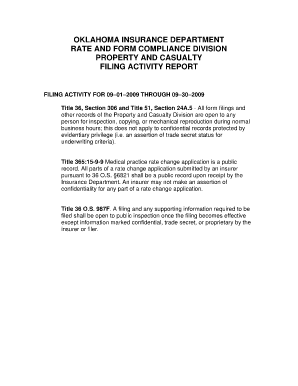

Insurance Verification Form Templates

What are Insurance Verification Form Templates?

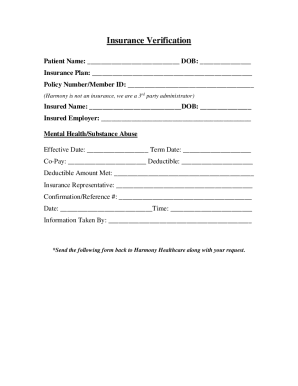

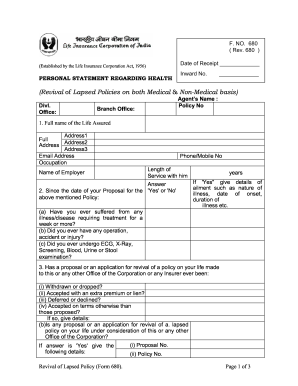

Insurance Verification Form Templates are standardized documents used by insurance companies to collect and verify information about an individual's insurance coverage. These templates help streamline the verification process and ensure that all necessary information is gathered accurately.

What are the types of Insurance Verification Form Templates?

There are several types of Insurance Verification Form Templates, including but not limited to:

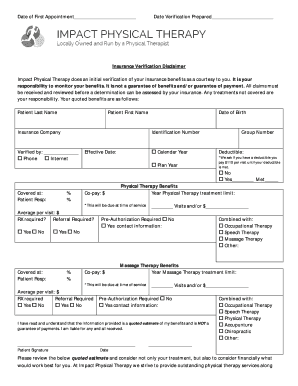

Patient Information Form Template

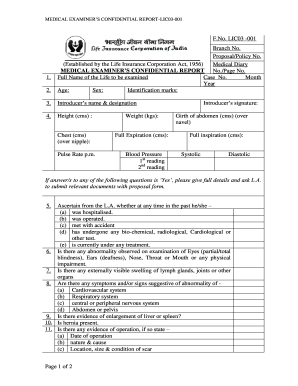

Medical History Form Template

Dental Insurance Verification Form Template

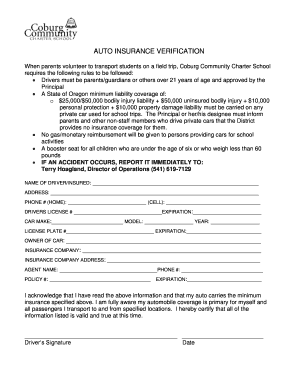

Auto Insurance Verification Form Template

Property Insurance Verification Form Template

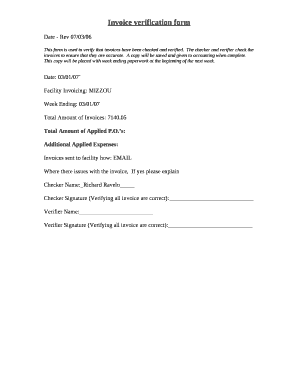

How to complete Insurance Verification Form Templates

Completing Insurance Verification Form Templates is a straightforward process that involves the following steps:

01

Gather all necessary information such as patient's personal details, insurance policy number, and coverage details

02

Fill in the required fields accurately and completely

03

Double-check the information provided to ensure accuracy and completeness

04

Sign and date the form where necessary

05

Submit the completed form to the relevant insurance company or healthcare provider

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Insurance Verification Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a verfication form?

A verification form is a certification to prove or confirm the status of an individual. The process usually requires a third (3rd) party to provide documentation, such as a letter, as evidence. After the form has been completed, the party verifying the information requested should be signed.

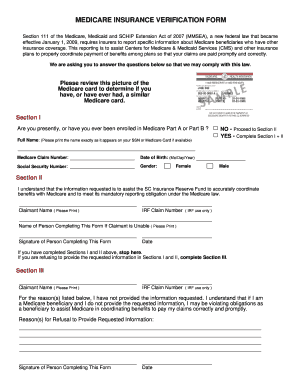

What methods can you use to verify a patient's insurance benefits?

Call the Payer This is the automated system when you call an insurance company. The IVR will go through questions to confirm information to provide the basics of that patient's eligibility. It is possible to speak with a human at an insurance company.

What is insurance eligibility verification?

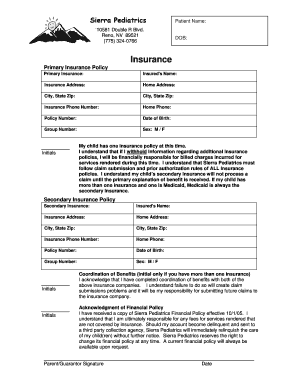

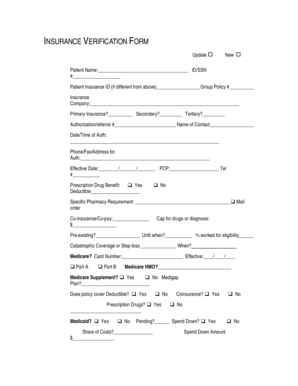

Patient eligibility and benefits verification is the process by which practices confirm information such as coverage, copayments, deductibles, and coinsurance with a patient's insurance company.

Which of the following is a common process for insurance verification?

Which of the following is a common process for insurance verification? Payer Portals streamline the insurance verification process by providing a single access for providers to verify all patients' coverage. A third party insurance vendor will not provide insurance verification beyond their services.

What are the steps in verifying insurance?

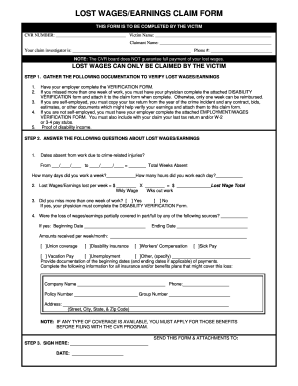

1. Insurance Verification Checklist Insurance name, phone number, and claims address. Insurance ID and group number. Name of insured, as it isn't always the patient. Relationship of the insured to the patient. Effective date of the policy. End date for the policy. Whether coverage is currently active.

What information is needed in order to verify insurance coverage?

The name of the insurance company. The name of the primary insurance plan holder and their relationship to the patient. The patient's policy number and group ID number (if applicable). and. The insurance company's phone number and address.

Related templates