Surety Bond Form Pdf - Page 2

What is Surety bond form pdf?

Surety bond form pdf is a standardized document that outlines the terms and conditions of a surety bond agreement in a digital format, easily accessible and editable using PDF software.

What are the types of Surety bond form pdf?

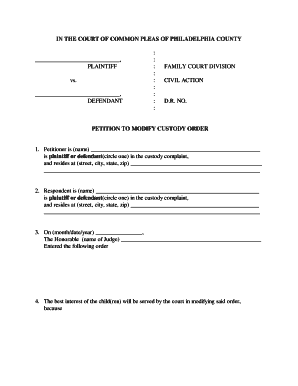

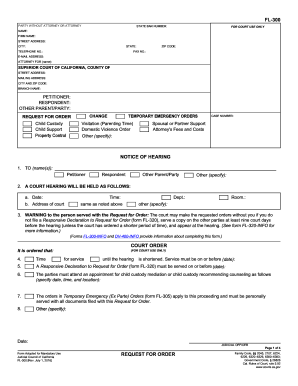

There are several types of Surety bond forms available in PDF format, including: Performance Bond, Payment Bond, Bid Bond, License and Permit Bond, and Court Bond.

Performance Bond

Payment Bond

Bid Bond

License and Permit Bond

Court Bond

How to complete Surety bond form pdf

Completing a Surety bond form pdf is a simple process that involves the following steps:

01

Open the PDF file in a PDF editor like pdfFiller

02

Fill in the required fields with the necessary information

03

Review the document for accuracy

04

Save and share the completed form electronically

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Surety bond form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 4 types of surety bonds?

However, to understand surety bonds, it may be helpful to break them down into four categories: contract bonds, judicial bonds, probate court bonds, and commercial bonds. In addition to these four categories, it's important to understand the basics of what surety bonds are, as well as how to obtain them.

What is an example of a surety bond?

Examples of Surety Bonds Includes bid or proposal bonds, performance bonds, payment or labor and material bonds, maintenance bonds and supply bonds. These bonds are required by state or federal law for most public construction projects or by a private developer.

What is a real life example of a surety bond?

For example, a hospital (the obligee) that wants to build a new wing would require the construction company it hired (the principal) to purchase a surety bond large enough to cover the size of the construction project budget in case some detrimental incident occurs that prevents the construction company from completing

How do you explain a surety bond?

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

How do I get a surety bond in Virginia?

HOW DO I APPLY FOR A VIRGINIA SURETY BOND? Applying for a Virginia surety bond is quick and easy! Click on “Apply Now”, complete our streamlined online application, and receive your quote in minutes. Once approved, your surety bond can be issued and a copy sent to you via email.

How do I get a surety bond in Kentucky?

How Do I Get a Surety Bond in Kentucky? The principal researches the type of bond needed, and applies for that kind of bond with a surety company. The surety company prepares an agreement of indemnity and returns it to the principal.