Surety Bond Format Pdf

What is Surety bond format pdf?

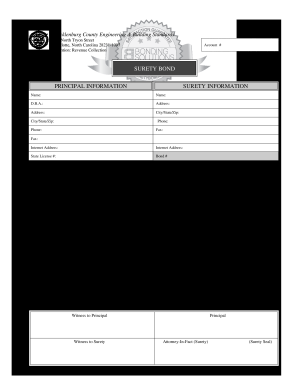

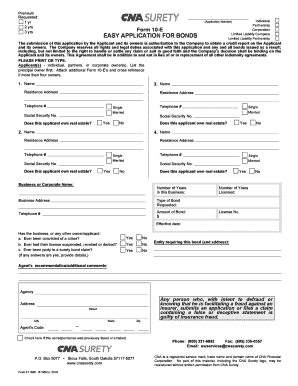

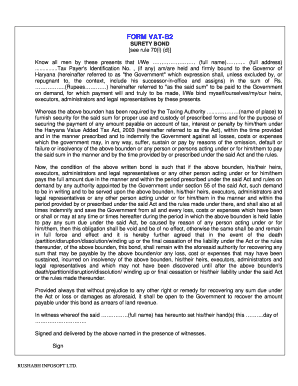

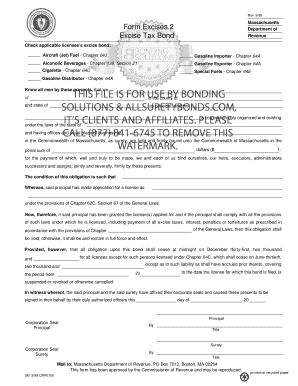

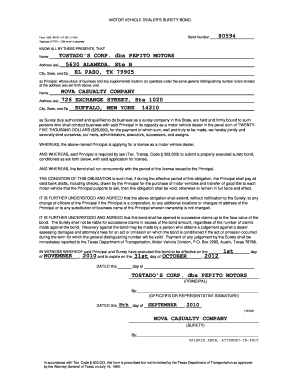

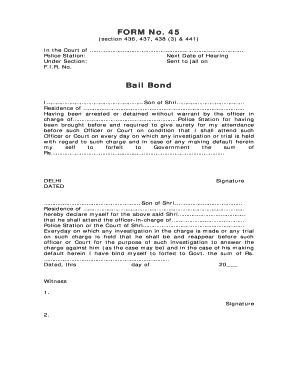

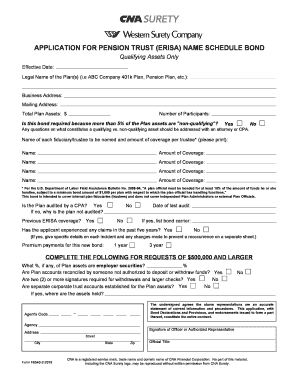

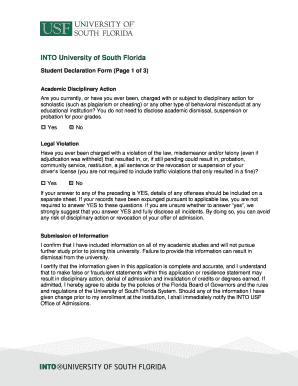

A Surety bond format pdf is a standardized document that outlines the terms and conditions of a surety bond in a PDF format. It includes details such as the parties involved, the bond amount, and the obligations of the parties. The PDF format ensures easy access and consistent display across devices.

What are the types of Surety bond format pdf?

There are several types of Surety bond format pdf, each tailored to meet specific needs. Some common types include: Performance bonds, Payment bonds, Bid bonds, Contract bonds, License and permit bonds, and Court bonds.

How to complete Surety bond format pdf

Completing a Surety bond format pdf is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.