Itemized List For Insurance Claim Template Excel

What is Itemized list for insurance claim template excel?

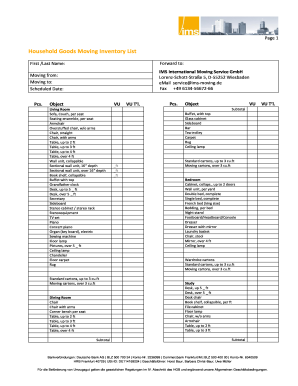

An itemized list for insurance claim template excel is a document that helps individuals or businesses to detail their insurance claims in a structured format using Microsoft Excel. It allows users to list and categorize all items being claimed, along with their corresponding values and descriptions.

What are the types of Itemized list for insurance claim template excel?

There are different types of itemized lists for insurance claim template excel, including:

Personal property insurance claim template

Home insurance claim template

Auto insurance claim template

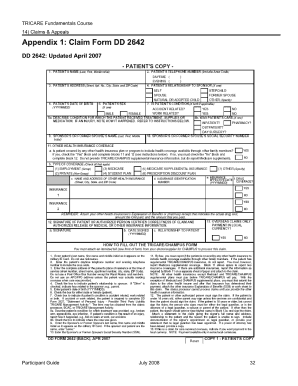

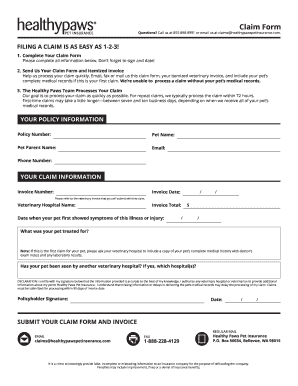

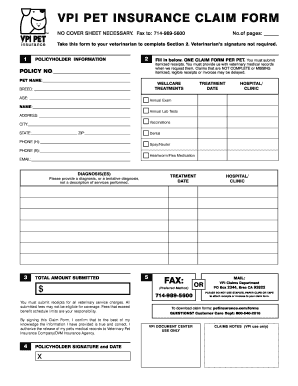

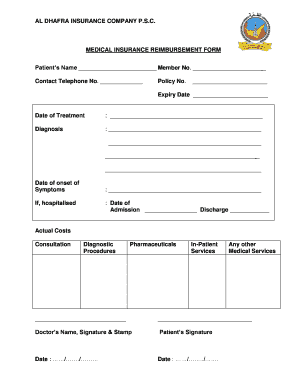

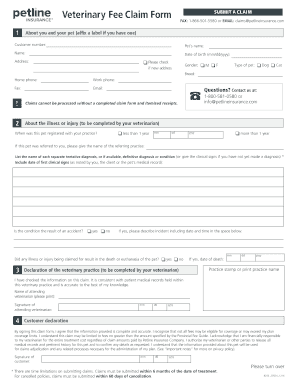

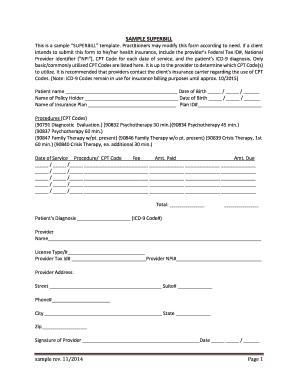

Health insurance claim template

Business insurance claim template

How to complete Itemized list for insurance claim template excel

Completing an itemized list for insurance claim template excel can be done by following these steps:

01

Open the template in Microsoft Excel

02

Enter your personal or business information at the top of the document

03

List each item being claimed in the appropriate category

04

Provide a detailed description and value for each item

05

Ensure all information is accurately filled out and organized

06

Save the completed document for submission with your insurance claim

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Itemized list for insurance claim template excel

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write inventory of your personal belongings?

A written inventory: A comprehensive home inventory list catalogs your belongings and should include the item description (make, model and serial number, if applicable), value and purchase date. You can create your own list using a spreadsheet or fill out a home inventory checklist that's ready to go.

How do I make a itemized list for an insurance claim?

Begin your list by documenting each room separately. Write down each item under the categorical name of the room (i.e., Living Room, Kitchen, Bedroom, etc.). Items such as “clothing” or “shoes” can be grouped together following a more specific amount of quantity. Such as, “Clothing – 25 shirts and 15 pants.”

What is a list of contents for insurance claims?

Also referred to as a personal property inventory list, it dictates the item's name, a brief description, the date it was purchased, an estimated value with a receipt (if you have it). It's important to take photos or videos of the personal belongings on your personal property inventory list.

How do I make an insurance inventory list?

Ideally, your inventory should include information like the item's description and the item's purchase price or estimated replacement value. For an extra detailed home inventory list, include the item's purchase date and serial or model number.

What is an example of inventory insurance?

Inventory insurance covers you against damage to your inventory, usually including electronics and computers. These insurances cover you, for example, in the event of fire, water damage, vandalism, or theft.

How do I make a contents list for insurance claim?

Getting Started: A good home inventory includes a detailed list of your possessions, including receipts, descriptions, and photos of your home contents. o Start with new purchases and add older items later. o Group your possessions into logical categories, e.g., by hobby, by room in your home, etc. Be specific.