Insurance Claim Checklist Template

What is Insurance claim checklist template?

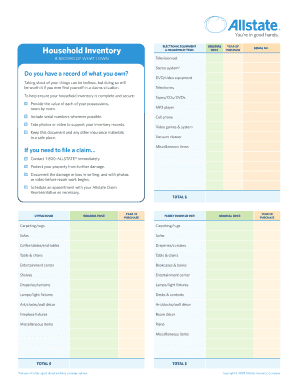

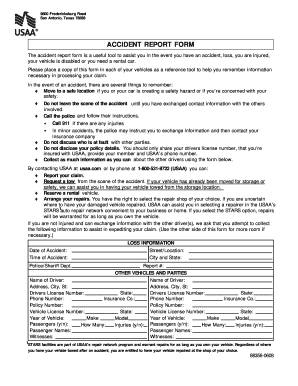

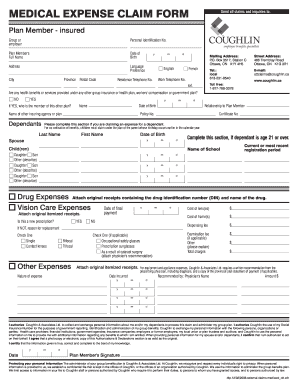

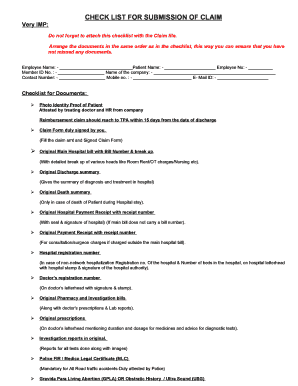

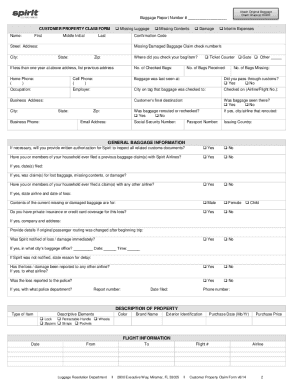

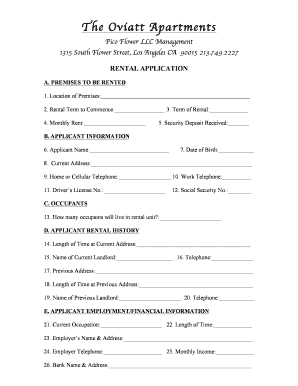

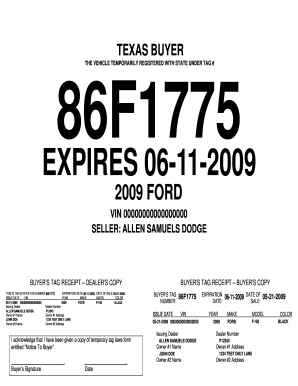

An Insurance claim checklist template is a tool used to help individuals and businesses organize and keep track of the necessary information and documentation required to file an insurance claim. It serves as a guide to ensure all the essential details are included to expedite the claims process.

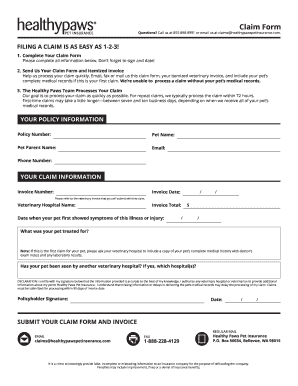

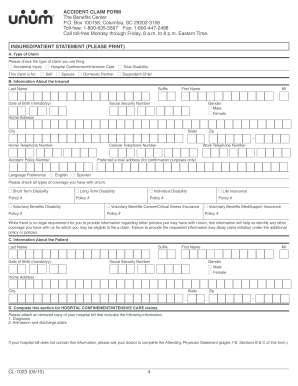

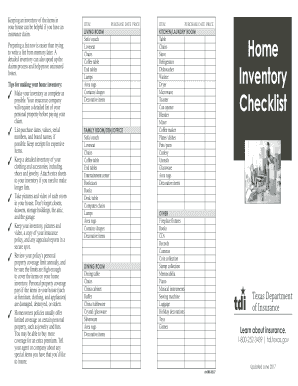

What are the types of Insurance claim checklist template?

There are various types of Insurance claim checklist templates based on the type of insurance coverage. Some common types include: 1. Auto insurance claim checklist 2. Home insurance claim checklist 3. Health insurance claim checklist 4. Property insurance claim checklist 5. Travel insurance claim checklist

How to complete Insurance claim checklist template

Completing an Insurance claim checklist template is straightforward if you follow these steps: 1. Gather all relevant documents such as policy information, receipts, and photo evidence. 2. Fill in all the required fields accurately and completely. 3. Review the checklist to ensure nothing is missing. 4. Save a copy for your records and submit it to your insurance provider.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.