Payment Bond Claim

What is Payment bond claim?

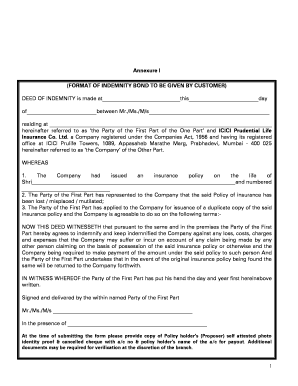

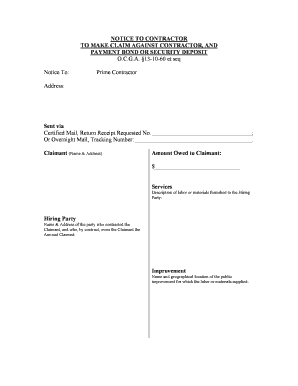

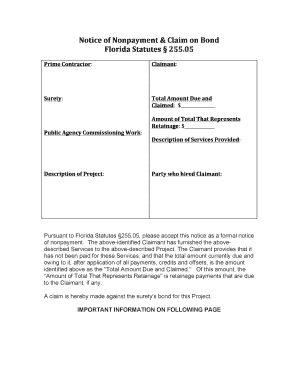

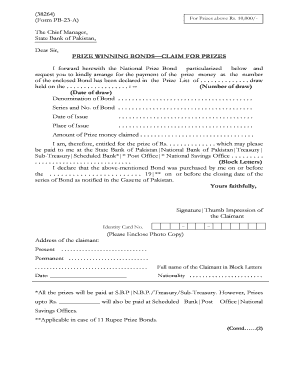

A Payment bond claim is a legal action taken by a subcontractor or supplier to recover unpaid sums from a construction project. It is a tool to ensure that those who have provided labor or materials are compensated for their contributions.

What are the types of Payment bond claim?

There are two main types of Payment bond claims: first-tier claim and second-tier claim. First-tier claim: This type of claim is filed directly against the bond held by the general contractor. Second-tier claim: This type of claim is filed against the bond held by the subcontractor.

First-tier claim

Second-tier claim

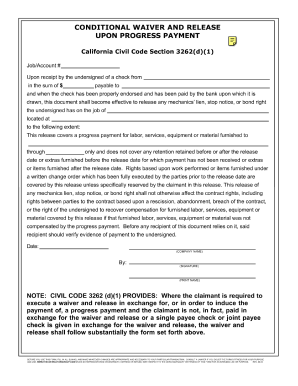

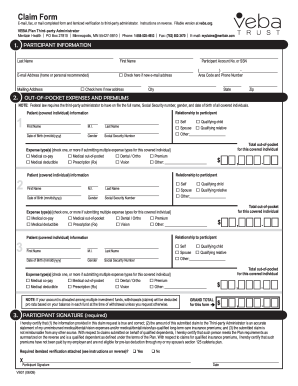

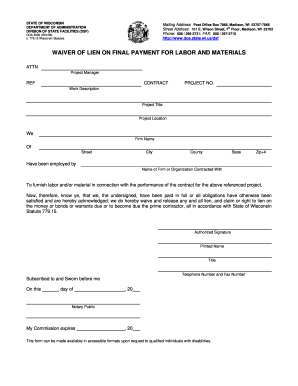

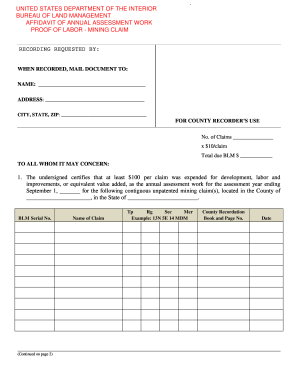

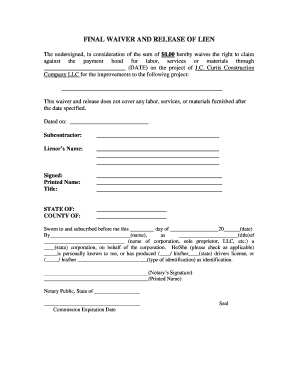

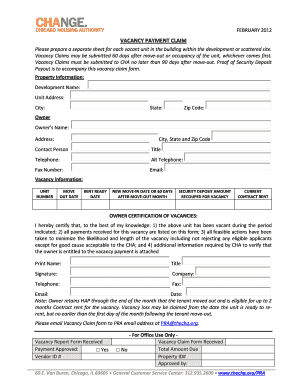

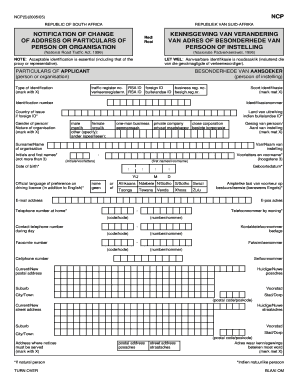

How to complete Payment bond claim

Completing a Payment bond claim can seem daunting, but with the right tools and guidance, it can be a straightforward process. Here are steps to complete a Payment bond claim:

01

Gather all necessary documentation, including invoices, contracts, and proof of delivery.

02

Submit the claim form to the appropriate parties, ensuring all information is accurate and complete.

03

Follow up with the parties involved to ensure the claim is processed in a timely manner.

04

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payment bond claim

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do you get your money back from a performance bond?

Performance bonds are refundable, but it depends on the situation. Generally speaking, when you purchase a bond it is considered “fully earned” for its first term.

What is a 100% payment and performance bond?

A payment and performance bond is a guarantee from the contractor that they will pay their subcontractors, material suppliers or laborers for work done. These bonds are usually issued on construction projects to protect against uncompensated losses in case of non-performance by the main contract holder.

How do payment and performance bonds work?

A payment bond and a performance bond work hand in hand. A payment bond guarantees a party pays all entities, such as subcontractors, suppliers, and laborers, involved in a particular project when the project is completed. A performance bond ensures the completion of a project.

What is the difference between a performance bond and a payment bond?

Payment bonds ensure that contractors pay their material suppliers and subcontractors ing to their contracts. Performance bonds provide a financial guarantee to project owners that their contractor will perform ing to contract terms.

What does claim to bond mean?

A bond claim means the claimant is alleging you haven't fulfilled an obligation of yours that may be covered under the bond.

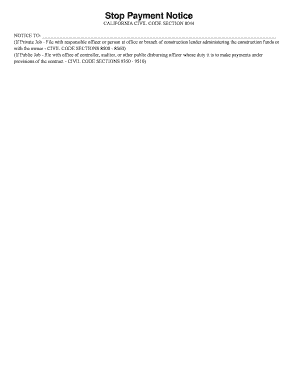

What is the deadline to file a bond claim in California?

Bond Claim Deadlines Must file suit against the surety if claim remains unpaid, and suit must be brought no later than 6 months from the expiration of the Stop Notice period.