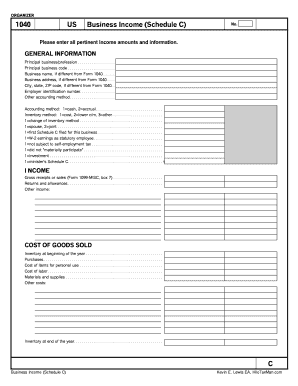

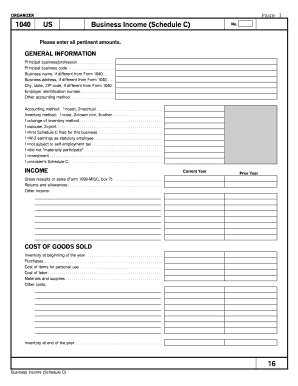

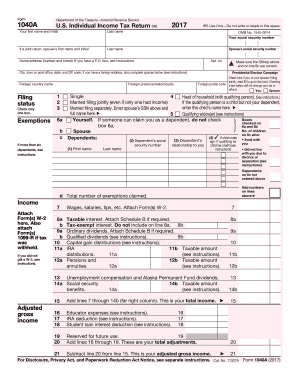

Business Tax Form 1040

What is Business tax form 1040?

The Business tax form 1040 is a document used by businesses to report their income, deductions, and credits to the IRS. It is an essential form for businesses to file their annual taxes accurately.

What are the types of Business tax form 1040?

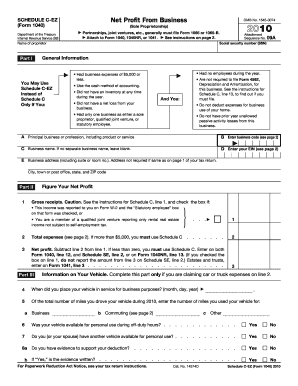

There are several types of Business tax form 1040 that businesses may need to file depending on their structure and activities. Some common types include:

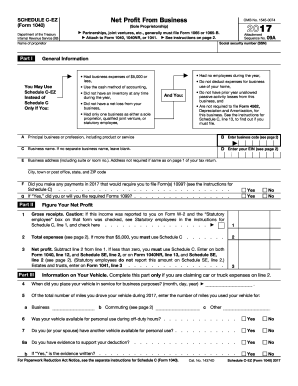

Form used by sole proprietors and single-member LLCs

Form 1040-SR: specifically for individuals age 65 and older

Form 1040-NR: for nonresident aliens who have US business income

Form 1040-SS: for US citizens or residents who are self-employed in the US territories

How to complete Business tax form 1040

Completing the Business tax form 1040 may seem daunting, but with the right tools and guidance, it can be a straightforward process. Follow these steps to successfully complete the form:

01

Gather all necessary financial documents, including income statements, receipts, and expense records.

02

Fill out the form accurately, making sure to include all relevant information and double-checking for any errors.

03

Submit the completed form to the IRS by the deadline to avoid any penalties or late fees.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Business tax form 1040

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

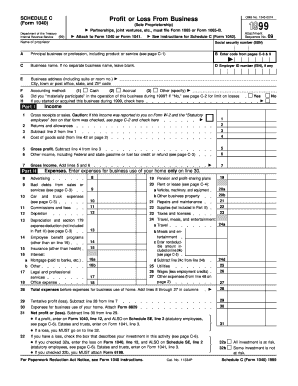

What is the difference between Schedule C and LLC?

When Would An LLC File a Schedule C? A single-member LLC, that has not elected to be treated as a corporation, uses the Schedule C to report profit or loss from the business. The LLC is considered a business structure allowed by state statute for other legal purposes but is disregarded or ignored for tax purposes.

What is the best tax form for LLC?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return.

Is a 1040 a business tax form?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

What tax form is used for business?

Income tax forms Sole business owners must also submit a Schedule C (Form 1040 or Form 1040-SR), Profit or Loss from Business. Additionally, partnerships must file an information return (Form 1065, U.S. Return of Partnership Income, and Form 965-A, Individual Report of Net 965 Tax Liability).

Is Schedule C the same as 1099?

A 1099 is not the same as Schedule C. A 1099 typically reports money exchanged between a payor and a payee. A copy of a 1099 usually goes to both the payee and the IRS. Depending on the type of income earned or 1099 received, you may report this on Schedule C or other Schedules of Form 1040.

Do you file a 1040 for a business?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.