Business Tax Form For Llc

What is Business tax form for LLC?

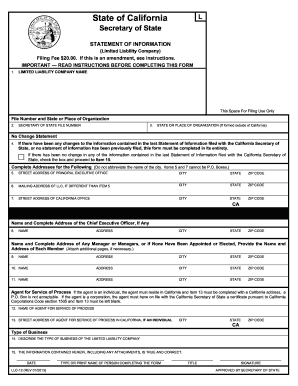

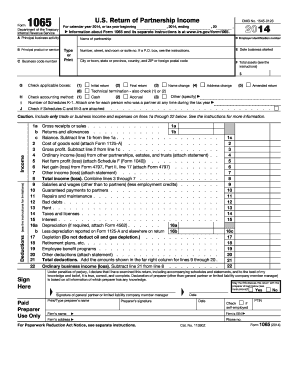

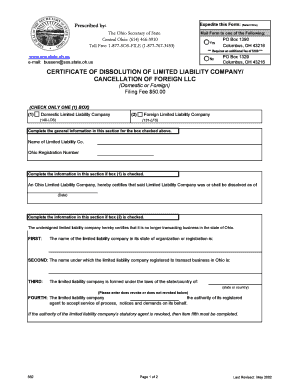

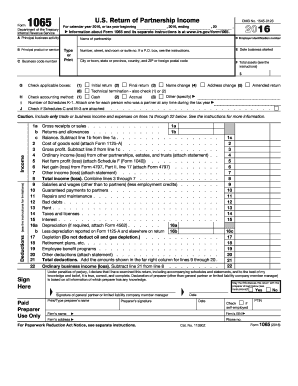

When it comes to managing the taxes for your Limited Liability Company (LLC), understanding the specific tax forms is crucial. The Business tax form for LLC is a document that LLCs need to file to report their business income and expenses to the IRS. This form helps the IRS determine the LLC's tax liability for the year.

What are the types of Business tax form for LLC?

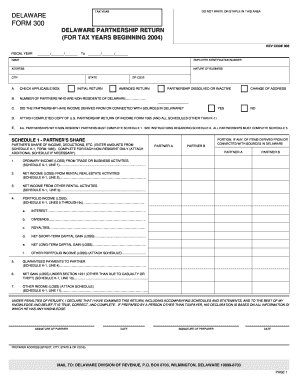

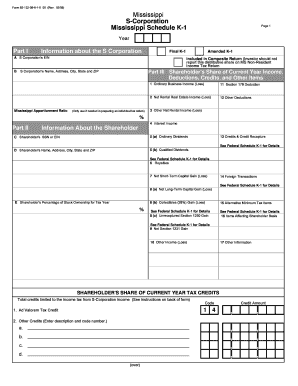

There are different types of Business tax forms for LLCs, depending on the way the LLC is taxed. The most common forms include: Form 1065 - used for multi-member LLCs taxed as a partnership, Form 1120 - used for LLCs taxed as a corporation, and Form 1040 - used for single-member LLCs taxed as a disregarded entity.

How to complete Business tax form for LLC

Completing the Business tax form for LLC can seem daunting, but with the right information and tools, it can be a smooth process. Here are some steps to help you complete the form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.