609 Credit Repair Letter Sample

What is 609 credit repair letter sample?

A 609 credit repair letter sample is a document used by individuals to dispute inaccuracies on their credit reports. It is based on section 609 of the Fair Credit Reporting Act, which allows consumers to request proof of any negative items on their credit report.

What are the types of 609 credit repair letter sample?

There are several types of 609 credit repair letter samples that can be used depending on the situation. Some common types include:

Basic 609 credit repair letter sample

Debt validation letter sample

Goodwill letter sample

Pay-for-delete letter sample

How to complete 609 credit repair letter sample

Completing a 609 credit repair letter sample is a straightforward process. Here are the steps to follow:

01

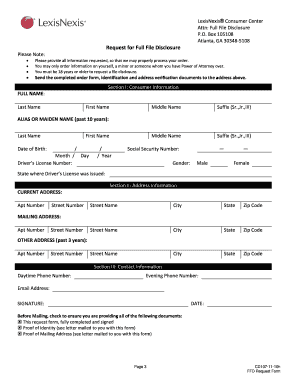

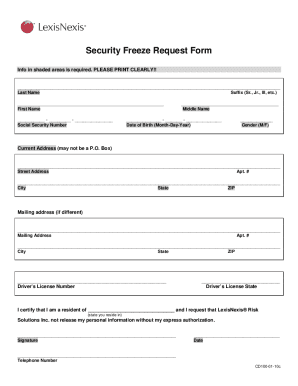

Gather all necessary information, including your personal details, the inaccuracies on your credit report, and any supporting documentation.

02

Address the letter to the credit bureau reporting the inaccurate information.

03

Clearly state the inaccuracies you are disputing and why they are incorrect.

04

Request proof of the disputed items as per section 609 of the Fair Credit Reporting Act.

05

Provide any supporting evidence or documentation to strengthen your case.

06

Send the letter via certified mail with a return receipt requested to ensure it is received by the credit bureau.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 609 credit repair letter sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a 609 template?

The 609 letter is similar to a debt verification letter you would send to a third-party collector when trying to validate the legitimacy of a balance due, which is your right under the Fair Debt Collection Practices Act.

How do I write a 609 credit dispute letter?

I am exercising my right under the Fair Credit Reporting Act, Section 609, to request information regarding an item that is listed on my consumer credit report. Per section 609, I am entitled to see the source of the information, which is the original contract that contains my signature.

Do 609 letters still work?

Does the 609 letter really work? If your argument is valid, the credit agency will delete the item from your credit report. However, if the credit agency can provide you with information that proves the item recorded is accurate, it will not be removed from your credit report.

What are 609 letters used for?

In short, a 609 letter is a method of requesting credit bureaus to remove false or negative information from your credit report. The Fair Credit Reporting Act (FCRA) makes this dispute method possible. Read on to learn what Section 609 is and how to effectively write a 609 letter to a credit reporting agency.

What is a 609 letter to remove charge off?

In a Nutshell A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

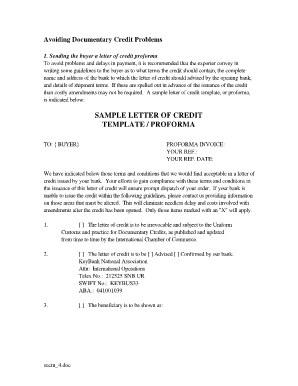

How do I write a section 609 letter?

609 letter template Dear Credit Bureau (Experian, TransUnion, or Equifax), I am exercising my right under the Fair Credit Reporting Act, Section 609, to request information regarding an item that is listed on my consumer credit report.