Printable Free 609 Credit Dispute Letter Templates

What is Printable free 609 credit dispute letter templates?

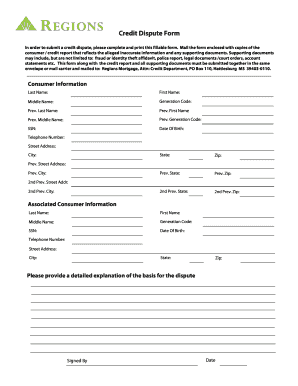

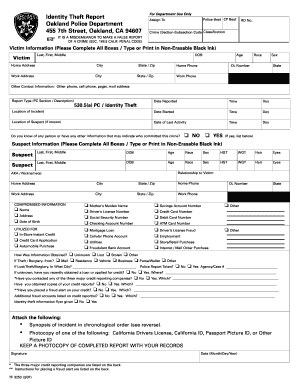

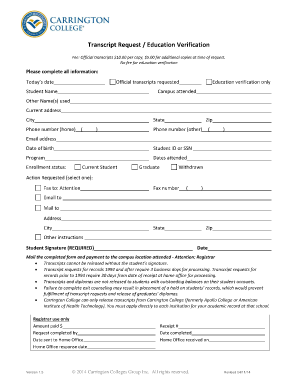

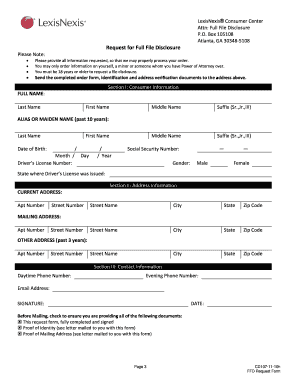

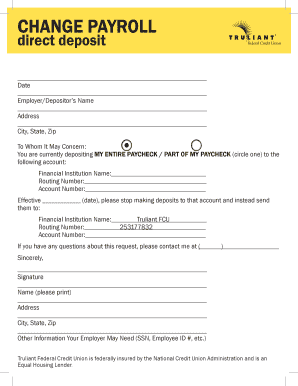

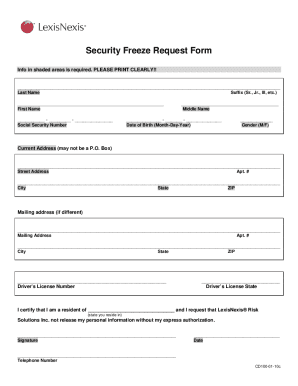

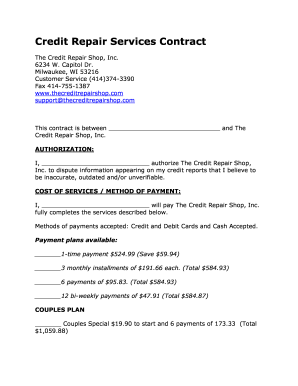

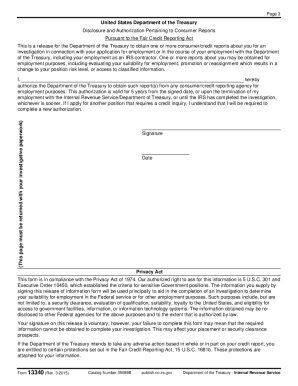

Printable free 609 credit dispute letter templates are pre-designed letters that consumers can use to dispute inaccurate information on their credit reports. These templates are provided for free and can be easily downloaded and filled out by users.

What are the types of Printable free 609 credit dispute letter templates?

There are several types of Printable free 609 credit dispute letter templates available, including:

Template for disputing incorrect personal information

Template for disputing incorrect account information

Template for disputing fraudulent accounts

How to complete Printable free 609 credit dispute letter templates

Completing Printable free 609 credit dispute letter templates is easy and straightforward. Follow these steps:

01

Download the template from a reputable source like pdfFiller.

02

Fill in your personal information and details of the inaccurate information you are disputing.

03

Provide supporting documents if available to strengthen your dispute.

04

Sign and date the letter before sending it to the credit bureau.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Printable free 609 credit dispute letter templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a 609 dispute letter PDF?

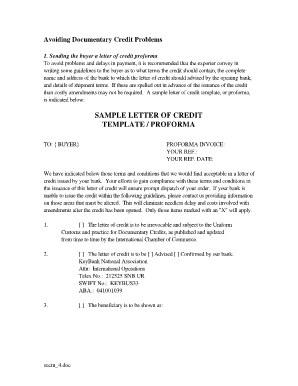

A 609 letter template is a form letter that is used to dispute items on a credit report. The letter is sent to the credit reporting agency, and the purpose is to request that the disputed information be removed.

What is the difference between a 609 and 604 dispute letter?

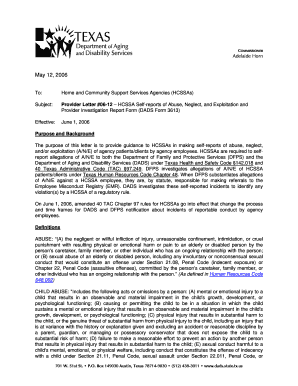

As a result, they're often confused. But they have different purposes, and only Section 609 will support a dispute letter. Under the FCRA, Section 604 defines the circumstances under which a consumer reporting agency may furnish a consumer report. This section is titled “Permissible purposes of consumer reports.”

Do 609 letters still work?

In general, a 609 letter is not a legal loophole that consumers can use to remove accurate information from their credit reports. This means they can't relieve you of any verifiable debt. If a credit bureau is able to verify your debt, it will stay on your report.

What is a 609 dispute letter template?

A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them. You'll find countless 609 letter templates online. however, they do not always promise that your dispute will be successful.

How do you write a good credit dispute letter?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

How do I write a 609 credit dispute letter?

I am exercising my right under the Fair Credit Reporting Act, Section 609, to request information regarding an item that is listed on my consumer credit report. Per section 609, I am entitled to see the source of the information, which is the original contract that contains my signature.