Blank 609 Letter

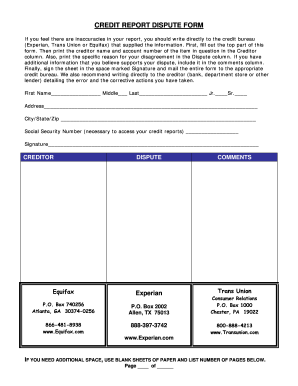

What is Blank 609 letter?

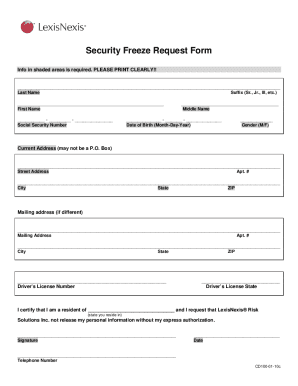

A Blank 609 letter is a formal request sent to a credit bureau to remove inaccurate information from your credit report. It is a powerful tool that consumers can use to dispute errors and improve their credit score.

What are the types of Blank 609 letter?

There are two main types of Blank 609 letters: 1. Original Creditor Validation Letter - This type of letter is used to request validation of debt directly from the original creditor. 2. Collection Agency Validation Letter - This type of letter is used to request validation of debt from a collection agency that is reporting negative information on your credit report.

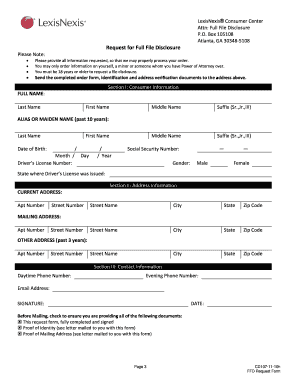

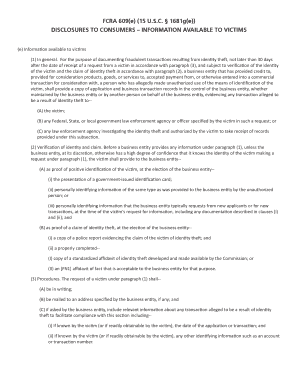

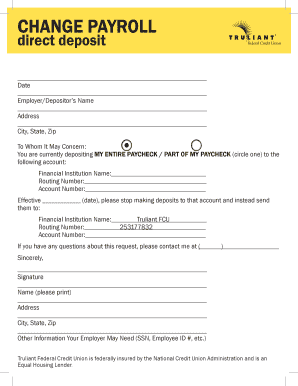

How to complete Blank 609 letter

To complete a Blank 609 letter, follow these steps: 1. Clearly state your personal information including name, address, and social security number. 2. Describe the inaccurate information on your credit report that you are disputing. 3. Request the removal of the inaccurate information in accordance with the Fair Credit Reporting Act. 4. Provide any supporting documentation that proves the information is inaccurate. 5. Send the letter via certified mail for tracking purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.