Section 604 Dispute Letter Template Pdf - Page 2

What is Section 604 dispute letter template pdf?

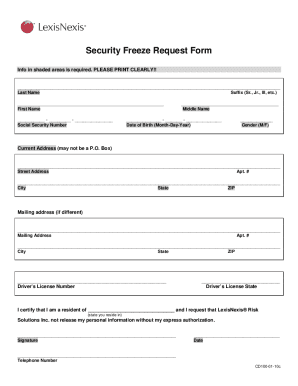

A Section 604 dispute letter template in PDF format is a document used to dispute inaccuracies on your credit report with the credit bureaus. It allows you to formally request corrections to any errors that may be negatively affecting your credit score.

What are the types of Section 604 dispute letter template pdf?

There are two main types of Section 604 dispute letter templates: basic and detailed. The basic template provides a general outline for disputing credit report errors, while the detailed template includes more specific information and documentation to support your dispute.

How to complete Section 604 dispute letter template pdf

Completing a Section 604 dispute letter template in PDF format is simple and straightforward. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share Section 604 dispute letter templates online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to streamline your document workflow.