Handwritten Credit Dispute Letters

What is Handwritten credit dispute letters?

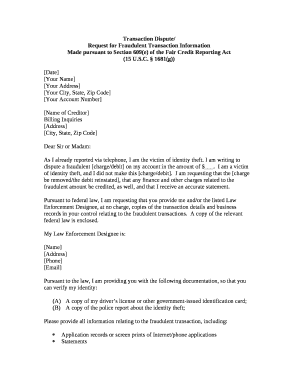

Handwritten credit dispute letters are personalized letters written by individuals to dispute inaccuracies or errors on their credit reports. These letters are typically sent to credit bureaus, creditors, or collection agencies to request for corrections or removal of incorrect information.

What are the types of Handwritten credit dispute letters?

There are different types of Handwritten credit dispute letters that can be used depending on the specific situation. Some common types include:

Initial dispute letter: This is the first letter sent to the credit bureau to dispute any inaccuracies on the credit report.

Follow-up dispute letter: If the initial dispute letter does not result in the desired outcome, a follow-up letter can be sent to provide additional information or evidence to support the dispute.

Goodwill letter: This type of letter is used to request creditors to remove negative information from the credit report as a gesture of goodwill.

Debt validation letter: When disputing a debt with a collection agency, a debt validation letter can be sent to request verification of the debt.

Pay for delete letter: This letter offers to pay the debt in exchange for the removal of negative information from the credit report.

How to complete Handwritten credit dispute letters

Completing Handwritten credit dispute letters can be a straightforward process if you follow these steps:

01

Start by addressing the letter to the appropriate recipient (credit bureau, creditor, or collection agency).

02

Clearly state the reason for the dispute and provide any relevant details or documentation to support your claim.

03

Be concise and professional in your communication, avoiding any unnecessary details or emotions.

04

Clearly state your desired outcome or resolution, whether it is a correction, removal, or validation of the information in question.

05

Sign the letter and keep a copy for your records before mailing it out.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Handwritten credit dispute letters

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do credit dispute letters need to be notarized?

It is highly recommended that you send these letters via "Certified Return Receipt". Each letter has a place for a notary to notarize your letter. This is not essential but can be helpful.

How do you write a good credit dispute letter?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Do sending dispute letters work?

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item—especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

How can I write a credit dispute letter?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Can I write my own dispute letter?

You may dispute information on your credit report by submitting a dispute form, or write your own letter that details your issues.

Can you hand write a credit dispute letter?

Traditionally, consumers would send handwritten credit dispute letters to the credit bureaus. However, these days, it's much more common to send a typed version through the mail or even to simply submit the information directly to the credit bureaus themselves through an online submission form.