609 Credit Repair

What is 609 credit repair?

609 credit repair refers to the process of disputing inaccuracies on your credit report under section 609 of the Fair Credit Reporting Act. By utilizing this legal loophole, individuals can challenge negative items that are affecting their credit score.

What are the types of 609 credit repair?

There are two main types of 609 credit repair: 1. DIY 609 credit repair: Individuals can take matters into their own hands by researching the process and submitting disputes themselves. 2. Professional 609 credit repair services: Hiring a reputable credit repair company to handle the process for you can save time and ensure a higher success rate.

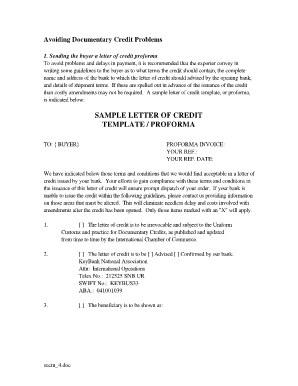

How to complete 609 credit repair

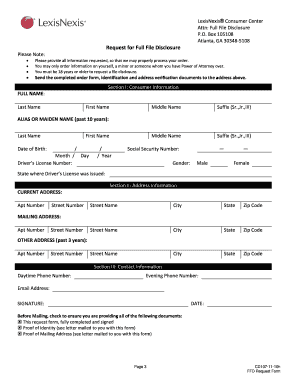

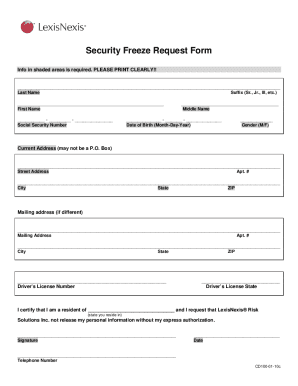

Follow these steps to successfully complete 609 credit repair: 1. Obtain a copy of your credit report from all three major credit bureaus. 2. Identify any inaccuracies or negative items that you believe are erroneous. 3. Draft a dispute letter citing section 609 of the FCRA and detailing the items you wish to challenge. 4. Send the dispute letter via certified mail to the credit bureau reporting the inaccuracies. 5. Wait for a response from the credit bureau and follow up if necessary to ensure the items are corrected.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.