Free Credit Repair Templates - Page 2

What is Free credit repair templates?

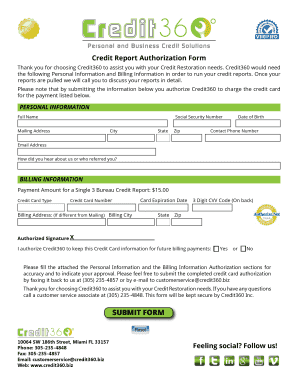

Free credit repair templates are pre-made documents designed to help individuals repair their credit by providing a structured framework to organize and track credit repair efforts.

What are the types of Free credit repair templates?

There are several types of Free credit repair templates available, including:

Credit repair letter templates

Credit report dispute templates

Credit monitoring templates

How to complete Free credit repair templates

Completing Free credit repair templates is easy and effective. Here are some steps to help you:

01

Download a Free credit repair template from a reputable source

02

Fill in your personal information and credit details accurately

03

Follow the instructions provided on the template to dispute inaccurate information on your credit report

04

Regularly update and track your progress using the template

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Free credit repair templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do credit removal letters work?

One possible solution: You may be able to remove late payments on your credit reports and start to improve your credit with a “goodwill letter.” A goodwill letter won't always work, but some consumers have reported success. It's worth trying because these derogatory marks on your credit can last seven years.

What do I send with the 609 letter?

To write a well-crafted 609 letter, first gather the following documents and make four copies of each: Credit report with the account in question circled and/or highlighted. Birth certificate. Social Security card.

Do I send the 609 letter to the collection agency?

How to write an effective 609 letter. The bottom line is that this letter is a request for the validation of the debt. You will only need to write a simple letter to the credit agencies (Equifax, Experian, and TransUnion) to request them to validate the disputable information.

How do I write a letter to get negative items from my credit report?

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

How to learn DIY credit repair?

How Can I Repair Credit Myself? Request Credit Report. Review Reports Carefully. Dispute Any Incorrect Information. Pay Bills on Time. Pay Off Delinquent Balances. Decrease Your Credit Utilization, and Pay Down Your Debt. Open Different Types of Accounts. Keep Accounts Open.

Do 609 letters work?

If disputes are successful, the credit bureaus may remove the negative item. Any accurate or verifiable information will stay on your credit report—a 609 letter doesn't guarantee its removal. However, you may increase your chances of removal if you follow a 609 letter template and provide enough information.