Payroll Change Form Template Excel

What is Payroll change form template excel?

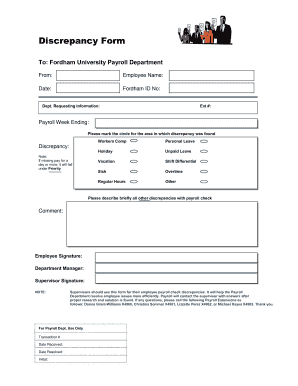

The Payroll change form template excel is a standardized document used to record changes in an employee's payroll information. This template is designed to help HR departments and payroll professionals track any adjustments made to an employee's salary, benefits, taxes, or other relevant information.

What are the types of Payroll change form template excel?

There are several types of Payroll change form templates available in Excel format, including:

Salary adjustment form

Tax withholding form

Benefit enrollment form

Direct deposit authorization form

How to complete Payroll change form template excel

Completing a Payroll change form template excel is a straightforward process. Follow these steps to ensure accurate record-keeping and compliance:

01

Start by entering the employee's name, job title, and employee ID number in the designated fields.

02

Specify the reason for the payroll change, such as a promotion, raise, or change in benefits.

03

Input the effective date of the change and any relevant details or notes in the comments section.

04

Review the completed form for accuracy and completeness before submitting it to the HR or payroll department for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payroll change form template excel

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much does it cost to put one person on payroll?

Most payroll providers have a base fee from $30 to $150 dollars per month that increases by $2 to $15 per employee. There are additional costs to add on depending on how regularly you pay employees and whether you are using basic payroll services or a full-service payroll provider.

How do you create a payroll?

How to set up payroll Step 1 – Apply for an EIN. Step 2 – Obtain your local or state business ID. Step 3 – Collect employee documents. Step 4 – Choose pay periods. Step 5 – Purchase workers' compensation insurance. Step 6 – Offer optional benefits to employees. Step 7 – Open a payroll bank account.

How do I prepare my monthly payroll?

Generally, you will need to follow these eight steps to process payroll: Gather time card information. Compute gross pay. Calculate payroll taxes. Determine employee deductions. Calculate net pay. Approve payroll. Pay employees. Distribute pay stubs.

How do I do payroll for 1 employee?

How do I do payroll manually? Agree upon a salary or hourly wage. Use a time clock or other means to track hours worked. Calculate gross wages. Deduct health care and any other pre-tax benefits you offer. Withhold income tax, FICA taxes and any state taxes that apply.

How to do payroll for a small company?

To get started: Step 1: Have all employees complete a W-4 form. Step 2: Find or sign up for Employer Identification Numbers. Step 3: Choose your payroll schedule. Step 4: Calculate and withhold income taxes. Step 5: Pay payroll taxes. Step 6: File tax forms & employee W-2s.

What is a payroll change form?

Quickly Document Changes in Payroll Status with a Payroll Change Notice. Easily track changes to an employee's pay and status including payroll job title and withholding rate with the Employee Payroll Change Form. This form also provides legal documentation in case of any disputes.