New Hire Forms Pdf

What is New hire forms pdf?

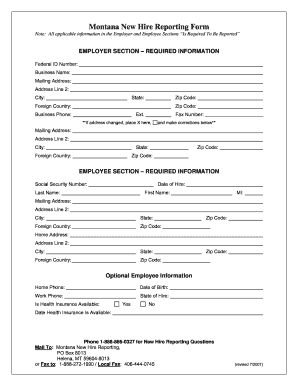

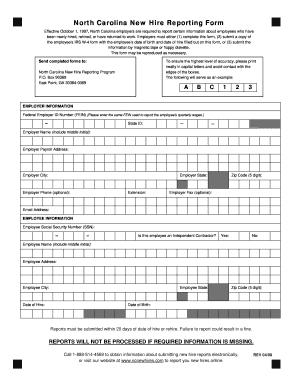

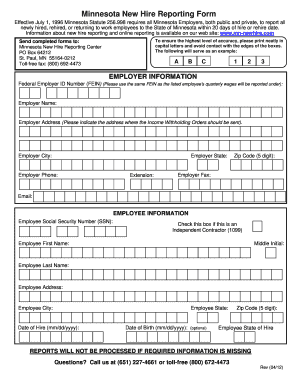

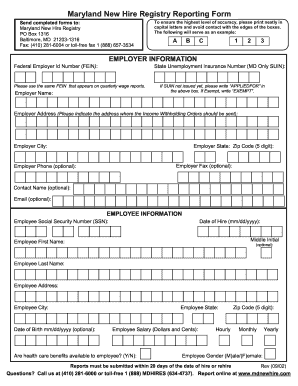

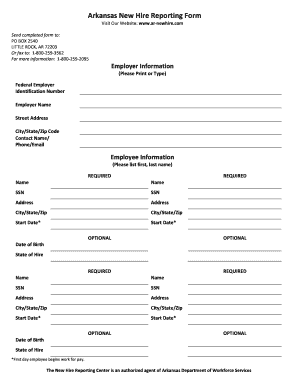

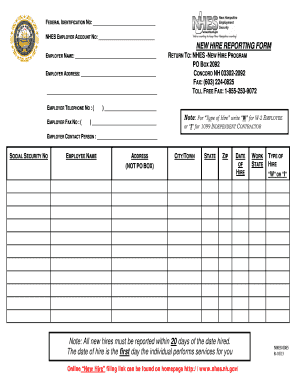

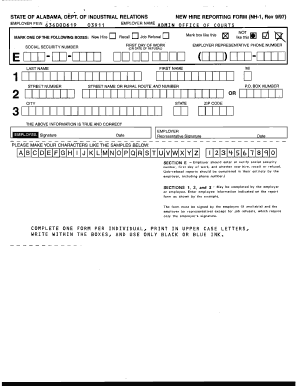

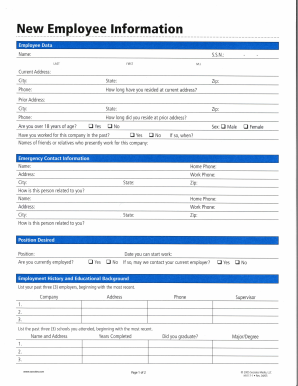

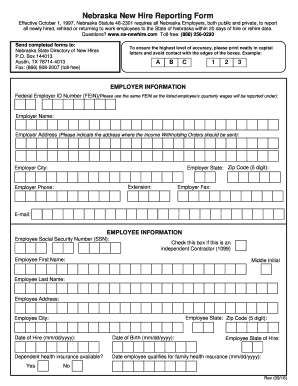

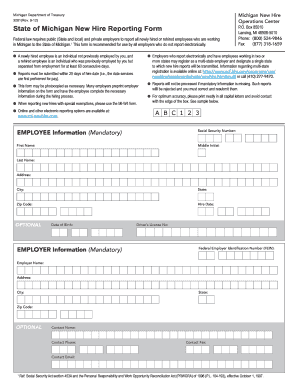

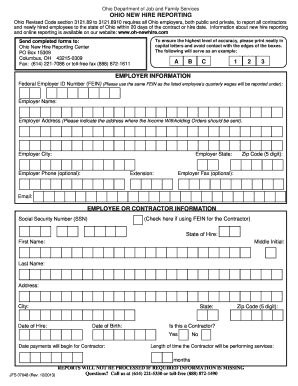

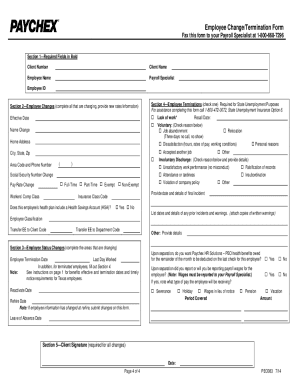

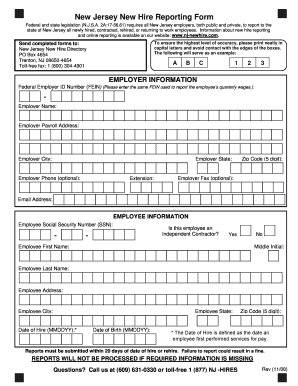

New hire forms pdf are documents that companies use to collect necessary information from new employees. These forms typically include personal information, tax details, emergency contacts, and other essential data needed for employment purposes.

What are the types of New hire forms pdf?

There are several types of New hire forms pdf that companies may use, including:

Employee Information Form

W-4 Form for Tax Withholding

Direct Deposit Authorization Form

Emergency Contact Form

I-9 Employment Eligibility Verification Form

How to complete New hire forms pdf

Completing New hire forms pdf is a simple process that can be done by following these steps:

01

Download the New hire forms pdf from your company's HR department or website.

02

Fill in the required information accurately and completely.

03

Double-check the form for any errors or missing information.

04

Sign and date the form where necessary.

05

Submit the completed form to your HR department.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a W-2 and a w4?

What's the difference between a W2- and a W-4? A W-4 is a form the employee fills out upon hiring to let an employer know how much to withhold from their paychecks. A W-2 is a form the employer fills out each tax year to record how much an employee was paid and how much tax was withheld.

What is the form you must fill out when you are hired?

I-9 form. Along with the proof of identification documents, employees must fill out an I-9 form to verify their employment eligibility. After the employee turns in the I-9 form, you must keep it on file, stored separately from other employee documents.

What forms do new employees need to fill out in CA?

Recommended and Required Documents For New Hires In California Offer Letter. I-9, Employment Eligibility Verification. Federal and State Tax Withholding Forms. Required Pamphlets. Other Important Documents.

What tax form should a new employee fill out?

Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

What tax forms do I need to fill out for a new employee?

4 employee tax forms to complete during the onboarding process EIN application. To hire an employee, your business must have an employer identification number (EIN). Form I-9. Form W-4. State withholding certificate. Form 941 or Form 944. Form 940. Form W-2.

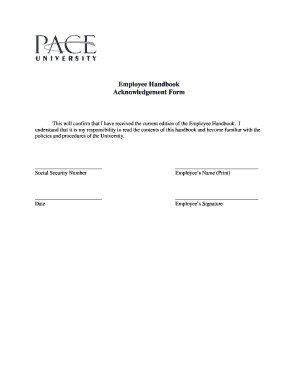

What forms do I need for a new hire?

New hire forms checklist Form I-9. W-4. State new hire tax forms. New hire reporting. Offer letter. Employment agreement. Employee handbook acknowledgment. Direct deposit authorization.