New Employee Forms Templates Canada

What is New employee forms templates canada?

New employee forms templates Canada refer to standardized documents used by Canadian employers to collect essential information from new employees. These forms are vital for onboarding processes and ensure that all necessary details are accurately provided.

What are the types of New employee forms templates canada?

There are several types of New employee forms templates Canada that organizations commonly use. Some examples include:

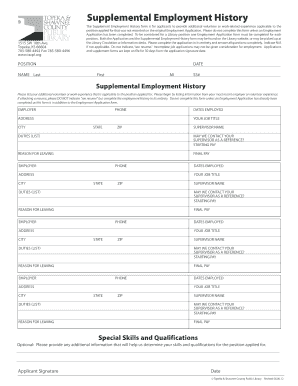

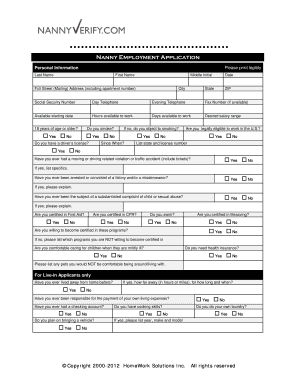

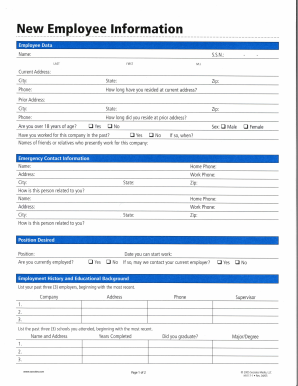

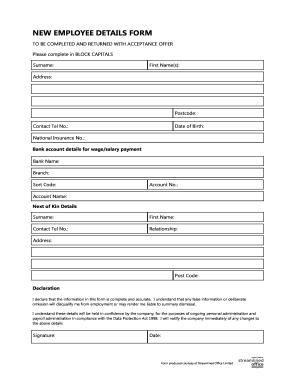

Employee Information Form

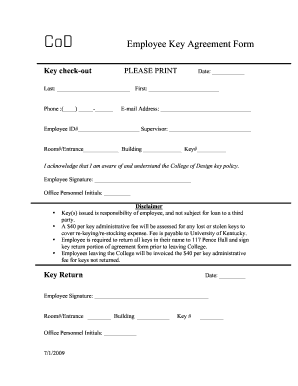

Employment Agreement Template

Direct Deposit Authorization Form

Emergency Contact Form

How to complete New employee forms templates canada

Completing New employee forms templates Canada is a straightforward process. Here are some steps to follow:

01

Fill in personal information such as name, address, and contact details.

02

Provide employment history, including previous employers and positions held.

03

Sign and date the forms to certify the accuracy of the information provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out New employee forms templates canada

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

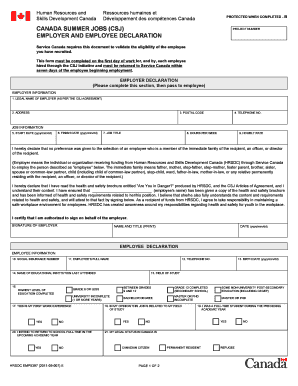

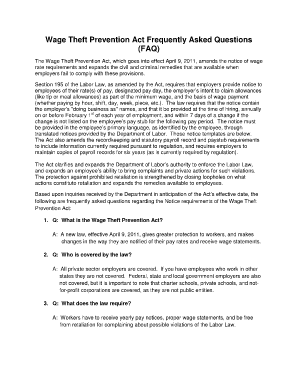

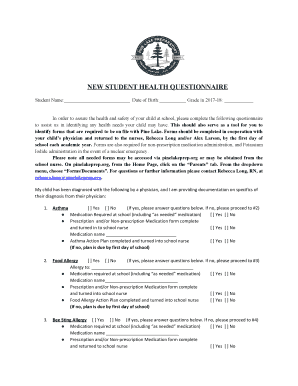

What forms must be completed for a new employee?

Make sure you and new hires complete employment forms required by law. W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

What documents required for new employee in Canada?

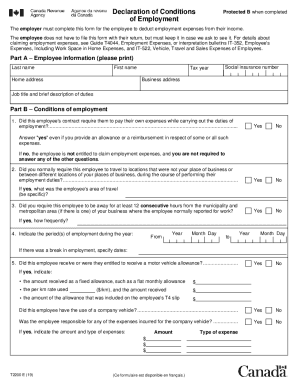

CRA and tax forms TD1 forms. Personal tax credits return. Employee's social insurance number. Federal form TD1. Provincial or territorial form TD1.

What forms do employers give new employees?

New hire forms checklist Form I-9. W-4. State new hire tax forms. New hire reporting. Offer letter. Employment agreement. Employee handbook acknowledgment. Direct deposit authorization.

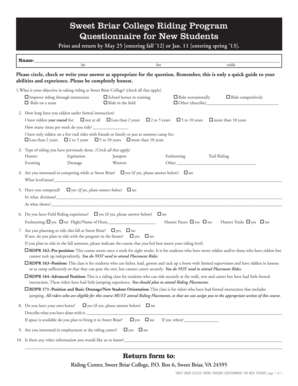

How do I register an employee in Canada?

Prior to hiring new employees, businesses need to register with the CRA for a business number and payroll deduction program. Every new employee needs to complete a TD1 Form and provide their SIN. To avoid penalties, ensure that payroll deductions are accurate. pay all deductions to the CRA by the remittance due dates.

How do I hire my first employee in Canada?

Here are some steps to follow when hiring an employee in Canada: Get familiar with local labour laws. Review minimum wage regulations and age restrictions for employees. Register as an employer with the Canada Revenue Agency. Set up and implement a payroll system. Verify that your employee is eligible to work in Canada.

How can a US company pay a Canadian employee?

There are three options for hiring and paying talent in Canada: Set Up a Foreign Entity in Canada. Having an entity in Canada allows you to create a branch or subsidiary and hire employees directly. Partner With an Employer of Record in Canada. Engage Canadian Talent as Contractors.