How Do I Notify Employee Of Garnishment

What is How do I notify employee of garnishment?

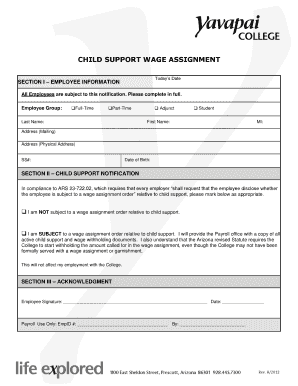

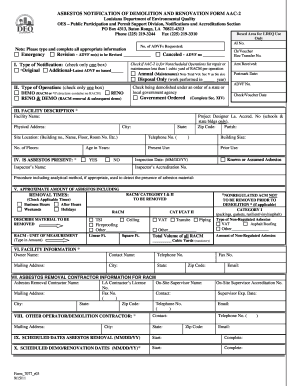

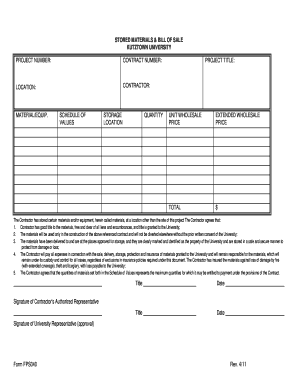

When an employer needs to inform an employee about a garnishment, it is crucial to do so promptly and accurately. Properly notifying an employee about garnishment ensures transparency and compliance with legal requirements.

What are the types of How do I notify employee of garnishment?

There are several ways to notify an employee of garnishment, including in-person communication, written notice, and electronic communication. Each method has its advantages and should be chosen based on the specific circumstances of the garnishment.

In-person communication

Written notice

Electronic communication

How to complete How do I notify employee of garnishment

To effectively complete the notification process, follow these steps:

01

Gather all relevant information about the garnishment, including the amount and reason

02

Choose the most appropriate method of notification based on the situation

03

Clearly explain the details of the garnishment to the employee

04

Provide the employee with any necessary documentation or forms related to the garnishment

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out How do i notify employee of garnishment

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the most wages can be garnished?

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

How do I write a letter of garnishment for wages?

Include the person's name in Human Resources if you have it. Begin the letter referencing the employee whose wages should be garnished, the debt and the person who is owed the debt. Your Writ of Garnishment/Execution should have already been served by the county's Sheriff, so you can include those details as well.

Can a debt collector garnish wages in NY?

In New York, most creditors can't garnish your wages unless they have a money judgment against you. To get a judgment, a creditor must first file a lawsuit against you. If they present evidence that you owe them money, the judge will order you to pay. This order is called a judgment.

Does NY allow bank account garnishment?

New York Account Levy In some states levy is called attachment or account garnishment. The names may vary but the concept is the same. Under New York's Exempt Income Protection Act of 2008 (EIPA), your bank may never take or freeze the first $1,740 in your bank or credit union account to pay a judgment (CVP § 5232).

How can I stop a garnishment in NY?

If you disagree with the garnishment, you can file an Order to Show Cause with the appropriate court. After receiving instructions from the Sheriff or Marshal, OPA will suspend the distribution of your deductions until further instructions are received from the City Marshal or Sheriff.

How do I set up an employee garnishment in QuickBooks?

QuickBooks Online Payroll Go to Payroll, then Employees. Select your employee. From Deductions & contributions, select Start or Edit. Select + Add Garnishment. In the dropdown menu ▼select the Garnishment Type. Enter a description. Enter the following fields based on the garnishment type you chose. Select Save.