Wage Garnishment Template - Page 2

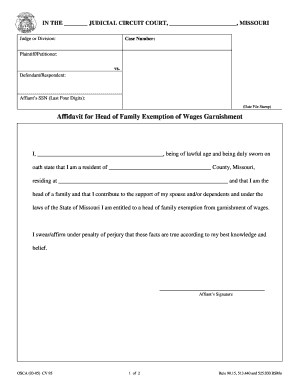

What is Wage garnishment template?

A Wage garnishment template is a legal document used by employers to deduct a portion of an employee's wages to satisfy a debt owed to a creditor. This template outlines the specifics of the wage garnishment including the amount to be deducted and the duration of the garnishment.

What are the types of Wage garnishment template?

There are several types of Wage garnishment templates that employers may use depending on the type of debt owed. Some common types include:

Child support garnishment

Tax garnishment

Creditor garnishment

How to complete Wage garnishment template

Completing a Wage garnishment template is a straightforward process. Here are the steps to follow:

01

Start by filling in the employee's personal information such as name, address, and social security number.

02

Specify the amount to be garnished and the reason for the wage garnishment.

03

Include any applicable legal references or court orders related to the garnishment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Wage garnishment template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a federally administered garnishment?

Administrative Wage Garnishment (AWG) is a debt collection process that allows a federal agency to order a non-federal employer to withhold up to 15 percent of an employee's disposable income to pay a delinquent non-tax debt owed to the agency.

How do I write a letter of garnishment?

Include the person's name in Human Resources if you have it. Begin the letter referencing the employee whose wages should be garnished, the debt and the person who is owed the debt. Your Writ of Garnishment/Execution should have already been served by the county's Sheriff, so you can include those details as well.

How do I write a letter of garnishment for wages?

Include the person's name in Human Resources if you have it. Begin the letter referencing the employee whose wages should be garnished, the debt and the person who is owed the debt. Your Writ of Garnishment/Execution should have already been served by the county's Sheriff, so you can include those details as well.

Is there a way around wage garnishment?

Act quickly to prevent wage garnishment You can file a Claim of Exemption any time after wage garnishment has started, but you'll only get wages back from the time after you submit the claim. If you act quickly, you can stop it before it even starts. By law, your employer cannot fire you for a single wage garnishment.

Why would the US Treasury garnish wages?

AWG is a debt collection process the permits a federal agency like the Department of Treasury to withhold in a garnishment up to 15% on an employee's disposable income. This applies to non-federal employees who have a delinquent non-tax debt owed to one of the federal agencies.

How do you calculate 25 of disposable earnings?

For example, if you make $500 per week in disposable income, only $125 of that amount can be subject to garnishment. This is because 25% of $500 is equal to $125, which is less than the amount your wages surpass 30 times the federal minimum wage ($217.50).